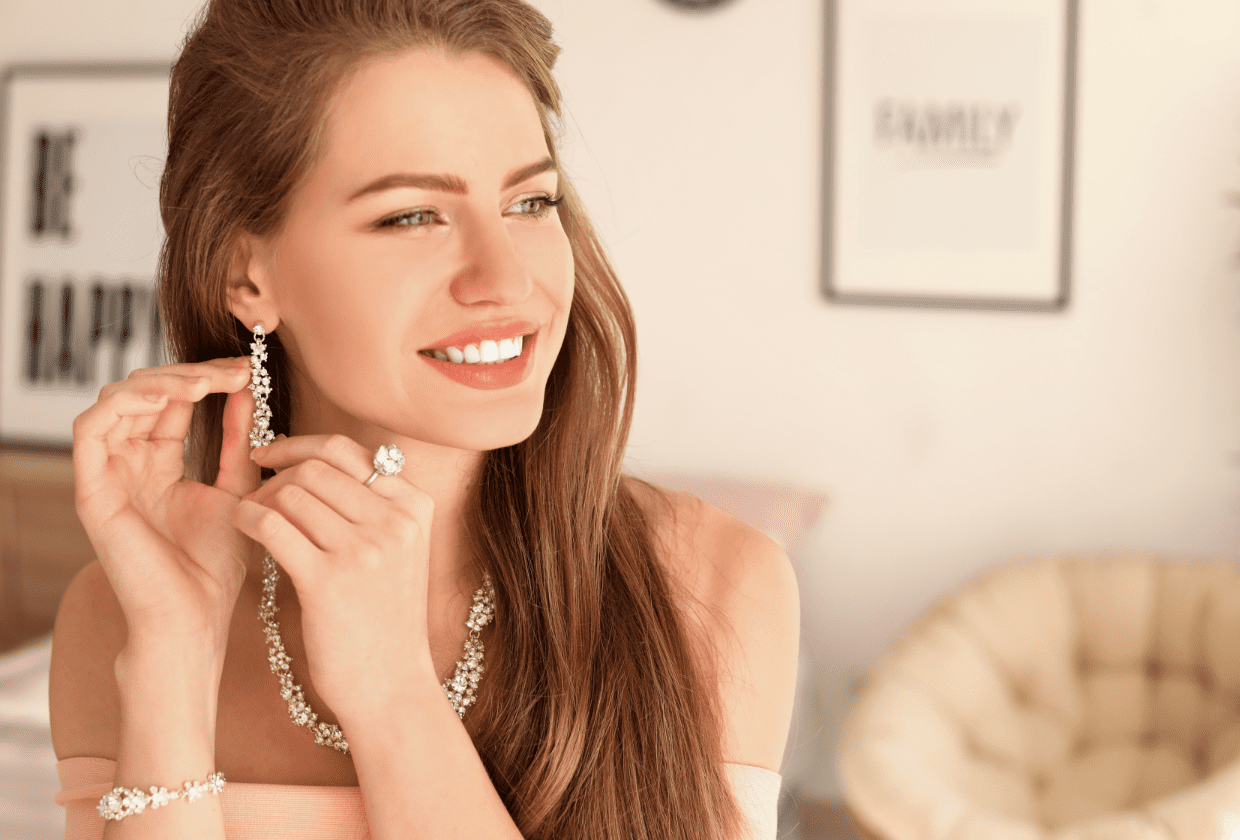

Collections, Jewelry,

and Art

PLAN FOR THE FUTURE

Safeguard your passions and cherished possessions

Inherited, gifted, earned, or otherwise, the jewelry, fine art, wine, antiques, and other luxury collections you own and love require special care and protection. And as you think about preserving your most cherished possessions, an off-the-shelf insurance policy might not suffice. Our fine collections advisors provide highly personalized service and access to top-tier coverage, customized to help protect your collections.

ELEVATED EXPERTISE

Trusted guidance for priceless collections

There are many variables to consider when you’re selecting insurance for fine art and collectibles. Typical homeowner and flood policies don’t offer sufficient protection for high value collections, as there may be a sub-limit on the policy, no coverage for breakage, and more exclusions.

The Baldwin Group’s fine collections advisors put their expertise and experience in this space to work for you, providing exclusive resources, access to the global insurance market, and tailor-made coverages specific to your unique needs.

SPECIALIZED SERVICES

Protection beyond

a lock and key

While life is unpredictable, your insurance program doesn’t have to be. At The Baldwin Group, we offer services you can count on to help protect your existing valuables and the ones you’ll acquire in the future. Get protection that offers the following and more:

- Market increase protections

- Customizable coverage

- Reimbursement of lost jewelry

- Easy addition of other valuables to your coverage plan

- Vault storage

INSURING HIGH-VALUE ITEMS

Proactivity provides the greatest protection

Your advisor will help you understand and apply the loss control measures that insurance companies are looking for. This helps put you in a better position when finding available coverage options at the most optimal price. Our experts will guide you through steps you can take to help obtain the best protection for your valuables, such as:

- Putting together provenance – the necessary documentation that proves the valuable item is yours and what it’s currently worth, including proof of ownership, bill of sale, replacement estimate, and most recent appraisal.

- Appraising your art and/or collectibles – to determine the value of what you’re insuring and help you understand the amount and type of coverage you should obtain.

- Determining the right amount of coverage – to protect your collection with a policy that is specifically designed for the intricacies of the unique items you own.

THE BALDWIN GROUP INSIGHTS

Stay in the know

Our experts monitor global events and the insurance industry to provide meaningful insights and help break down what you need to know, potential impacts, and how you should respond.

Your journey begins here

When you decide to partner with us, you choose to

protect your legacy with solutions and professionals

as unique as your lifestyle.