High Value Homes

PLAN FOR THE FUTURE

Safeguard your high-value home and the treasures within

ELEVATED EXPERTISE

Providing guidance

as personalized as

your home

Deciding to work with an insurance advisor is like handing a valet the keys to your sports car. You’re putting trust in them to keep your most valued possessions safe and protected. The Baldwin Group’s advisors understand the intricacies and complexities involved in protecting high value homes and assets. They’ll put their experience and connections with top insurance companies to work, guiding you through the options you have so you can make confident, informed decisions.

FUNDAMENTAL COVERAGE

Premium protection for your luxury home

Securing coverage for a high-value home isn’t like shopping for a standard homeowner’s policy – you’ll want to consider how you can best leverage options to protect your valuables, dwelling, and other assets. Our trusted advisors will help you navigate the coverage and services that are often included in a high value homeowners insurance solution, such as:

Enhanced and additional coverages:

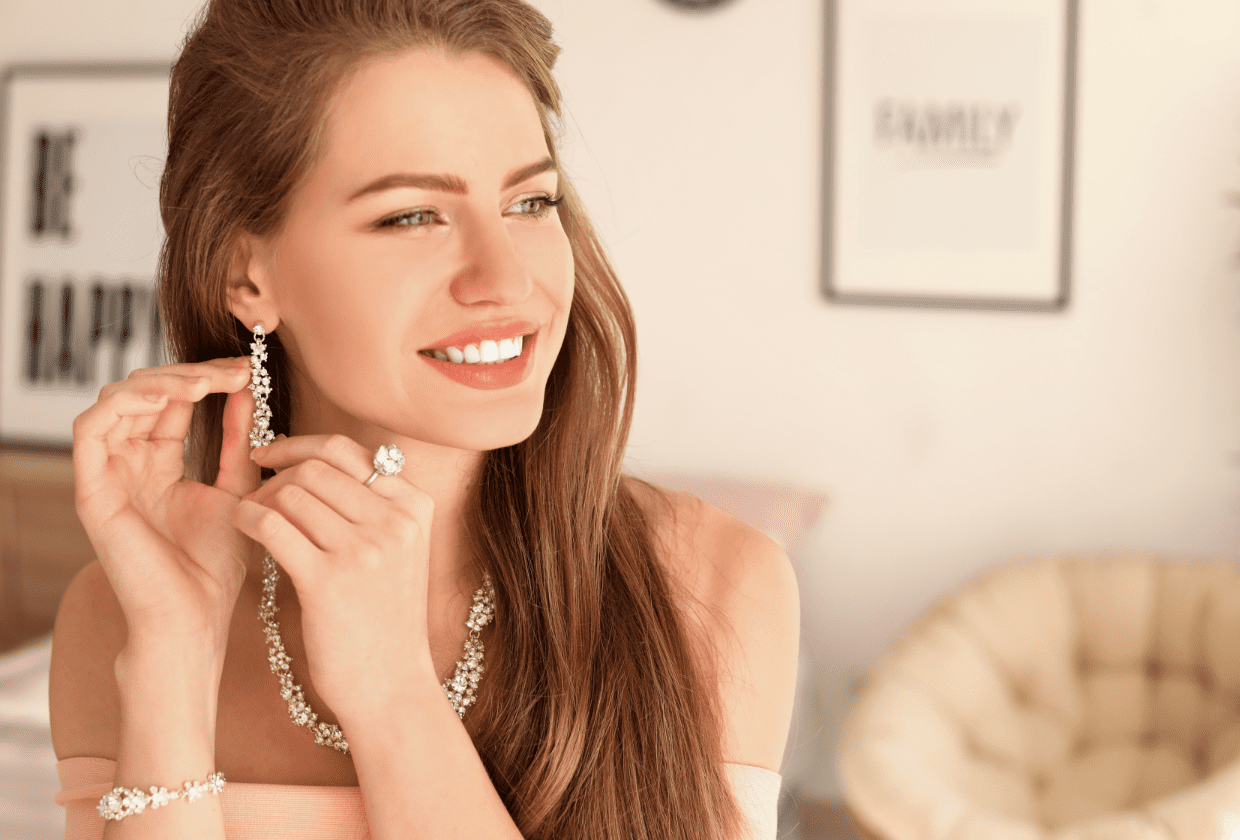

- Luxury items (such as jewelry, antiques, and wine collections)

- Dwelling protection

- Loss of use (for hotels and meals for throughout a loss of use of your home)

- Service line (for repair of underground wiring, piping, and more)

- Replacement cost vs. actual cash value

- Paying for or replacing a pair or set when one item is damaged

- Liability to often include legal defense costs outside normal limits

- “All risks”, not just typical covered perils

- Vacation and second homes

- Kidnap, ransom, and extortion

- Landscaping

- Identity theft

- Sewer backup

- Business property coverage

- Partial loss

- Employment practices liability insurance

Services:

- Complimentary home appraisals

- No-cost home inspections

- Risk management

- Loss mitigation

HOMEOWNERS INSURANCE

Do you have a beautiful home valued under $1 million?

Learn more about homeowner’s insurance, brought to you by our Guided Solutions team. View homeowners insurance.

THE BALDWIN GROUP INSIGHTS

Stay in the know

Our experts monitor global events and the insurance industry to provide meaningful insights and help break down what you need to know, potential impacts, and how you should respond.

Your journey begins here

When you decide to partner with us, you choose to

protect your legacy with solutions and professionals

as unique as your lifestyle.