PROTECTING THE POSSIBLE

Wealth Management

Your wealth management journey is a personalized roadmap towards achieving your financial dreams. Our comprehensive approach to building and executing financial and wealth strategies can help you achieve long-term success, maintain compliance, and protect your legacy. From plans to actions, we’re with you every step of the way – guiding you to make empowered decisions about the path you take to help safeguard and perpetuate your wealth.

WEALTH MANAGEMENT VIDEOS

Helping you plan for the future you want

ELEVATED EXPERTISE

Committed to delivering tangible results

Experience, refined skills, resources, and a commitment to helping you achieve your financial goals are the foundation we use to help you drive the decisions you make to better protect and grow your assets. Our highly skilled advisors put their years of experience to work for you. Having earned advanced degrees and professional certifications, such as CFA®, CFP®, ChFC®, and more, you can be confident that our team will provide goals-oriented advising and financial planning services that can help you succeed along your wealth management path.

DYNAMIC STRATEGIES

Distinct perspective, differentiated solutions

When it comes to financial strategy, one size does not fit all. Our team of wealth management advisors serves as your dedicated consultants, investing time and effort into a comprehensive understanding of your unique lifestyle and goals. From there, we craft tailored strategies to align with your vision of the future and the possibilities of what it holds. With a commitment to end-to-end excellence, we’ll guide you from strategic planning to diligent execution.

Accumulate wealth:

Let us be your guide toward financial freedom by crafting a customized strategy aligned with your short- and long-term objectives. Accounting for factors, such as taxes and risk tolerance, we continuously adapt and refine your plan to accommodate life’s ever-evolving circumstances.

Manage risk:

There’s more to a healthy portfolio than an amount of money at a given moment. By delving into your ambitions, risk tolerance, and the market, we develop comprehensive financial plans that can help nurture growth and safeguard your wealth.

Plan for your future:

Collaboration is the key to helping ensure you’re on the most effective path toward a successful financial future. Working as your advisor, we bring together the resources and experience of a large financial firm and the personal attention of a smaller one to help you understand and achieve the possible.

INNOVATIVE SOLUTIONS

Customized solutions, rewarding outcomes

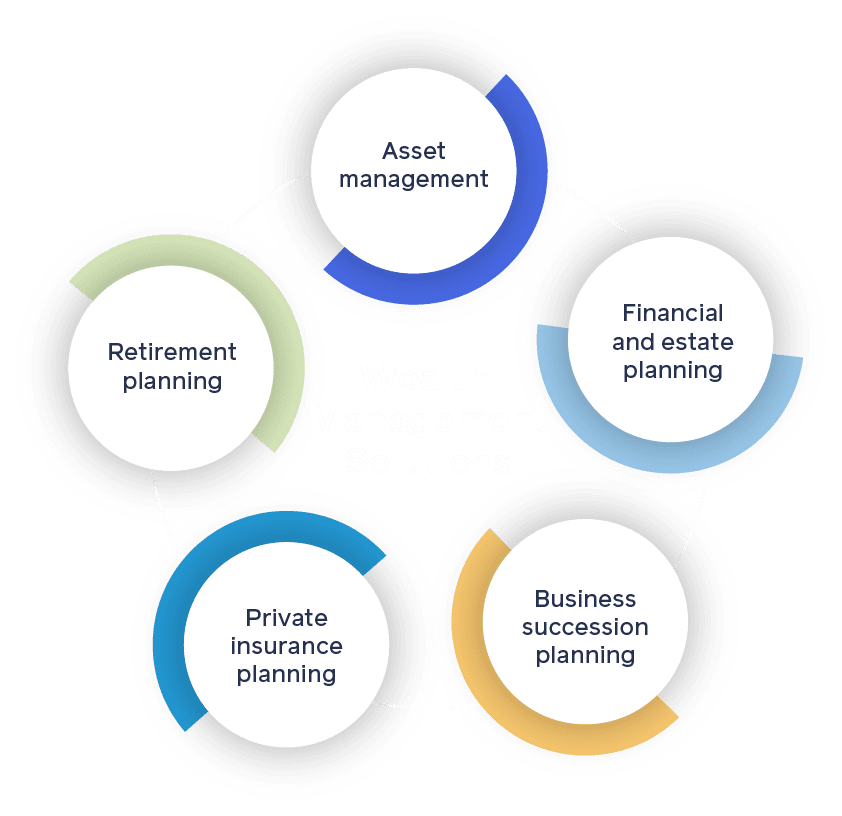

As active and invested advisors, we foster enduring relationships, offer innovative solutions that challenge conventional thinking, and put our robust resources to work – helping drive favorable outcomes. From buying new homes to retirement planning, you’ll get the guidance you need to help acquire and grow assets, while protecting your financial future.

Asset management

We offer a unique, integrated approach to personal asset management that combines asset allocation, asset location, tax-loss harvesting, and risk management into a unified process. Our advisors help clients achieve their financial goals through a strategic investment process that, as a fiduciary, ensures we always focus on what’s best for you.

By taking a comprehensive approach, we’ve changed the paradigm of wealth management and asset allocation. For individuals who are looking for personalized, unique investment strategies with tax advantages and (in some situations) a lower cost, our program provides access to portfolio managers to help you position strategies with your investment goals in mind. Investment planning includes an examination of a client’s current assets and investment risk tolerance.

The investment analysis projects investment needs and expenses for a specified goal (e.g. retirement) and analyzes current assets designated for the specified goal. Asset Allocation analysis provides you with various additional or alternative strategies available based on your time horizon and risk tolerance. Additionally, investment planning may include simulations to determine the probability of meeting your objective(s).

Financial and estate planning

Financial planning can greatly impact many other areas of your life. To help you secure a brighter financial future, we provide customized financial planning solutions and guidance that empower you to make those complex financial decisions. With highly trained professionals working in your corner, we also provide comprehensive services to help protect your assets for a more secure financial future.

Additionally, we offer estate planning and trust management as valuable tools for individuals to protect and distribute their assets according to their wishes. Our experienced advisors can help create a comprehensive solution to mitigate liability risks and help you better understand your duties as a trustee. Boasting a rich reservoir of expertise and deep industry contacts, our advisors design solutions tailored to your specific circumstances, which creates a secure environment to navigate the complexities of estate planning and trust management with confidence.

Business succession planning

We work collaboratively with your CPA and attorney to develop a comprehensive financial and estate strategy. Then, we can implement and optimize your plan with a host of tools to help ensure your business stays in your family for generations.

Private insurance planning

Proper insurance coverage is the foundation of a comprehensive financial plan. Together, our team of professionals will help you understand the amount and types of insurance you may require based on your unique lifestyle and needs. Examples of coverages we’ll explore include:

- Life insurance – As we grow older, get married, build families and start businesses, we come to realize more and more that life insurance is a fundamental part of having a sound financial plan. Life insurance can help you protect your family and loved ones, leave an inheritance, pay off debts and other expenses, and bring overall confidence that you’re legacy is protected.

- Disability insurance – Your income is the foundation of the life you created. Without income, everyday life and future plans can be affected. When you fall ill or have been injured in an accident, disability income insurance will help alleviate the potential loss of income for a period of time. A disability insurance policy can offer you flexible, robust coverage to help protect against the financial impact of a disability.

- Long-term care insurance – Long-term care insurance covers services designed to help you manage your quality of life. It differs from health insurance by reimbursing you for services that help you perform everyday activities if age, illness, injury, or a cognitive impairment makes it more challenging for you to take care of yourself. Because a health event can have a serious impact on a family’s finances, a comprehensive financial plan will often include a long-term care assessment as part of its insurance analysis or risk management section. It is important to consider the financial risks of certain unforeseen events, such as disability or prolonged illness that could require some level of long-term care. The overall wealth effect on a family from a nursing home stay can be significant.

Retirement planning

A successful retirement is the highest financial priority for many people. Because of the long-term nature of retirement and all the variables that go into determining potential success or failure, it is often the most difficult financial goal for which to plan. That’s where we step in to help. We’ll walk you through considerations, like longevity, expenses and inflation, asset allocation, and income, but most of all, withdrawals to help you effectively distribute funds from your nest egg.

Turn the possibilities into reality

When you decide to partner with us, you choose to protect your business and open the door new to ventures and opportunities.

Visit BrokerCheck for information regarding the third-party broker dealers utilized by The Baldwin Group Wealth Advisors, LLC.