Understanding your Total Cost of Risk (TCOR)

Effectively managing risk on a large-scale development project requires more than simply securing coverage—it demands a strategic, forward-looking approach. Developers face a wide range of exposures throughout the project’s life, routinely necessitating insurance for construction liability, property damage, surety and subcontractor default, and specialized risks, such as weather, environmental conditions, and site- or project-specific challenges.

Yet too often, developers underbudget or underestimate the true scope of insurance-related costs. Some account only for core policies, like Builder’s Risk or General Liability, without considering the full suite of coverages that may be needed or prudent to buy. Others only look at the coverages held by one party, such as the contractor or developer, without realizing the need to assess all parties involved and what each line of coverage protects.

This piece sets out to clarify what comprises a project’s Total Cost of Risk (TCOR) so developers and their capital partners can plan accordingly.

What is TCOR?

TCOR represents the full financial exposure tied to insurance and risk management for a development. While this figure includes insurance premiums, developers must also consider policy deductibles, potential uninsured exposures, risk control investments/requirements, and more.

Understanding your TCOR offers a clear picture of what it truly costs to manage and mitigate risk. It supports informed decision-making, strengthens lender and investor confidence, and helps avoid funding gaps or last-minute surprises.

Importantly, TCOR should not be treated as “set it and forget it.” Insurance budgets are often developed 12–24 months before construction begins, but much can change:

- Insurance market conditions may shift

- Catastrophic weather events may impact premiums

- Project scope or cost basis may evolve

- Lender insurance requirements may change

For this reason, we recommend revisiting and reassessing the project’s TCOR at least quarterly—especially on large-scale or CAT-exposed developments. A proactive, comprehensive risk strategy helps ensure both adequate protection and cost efficiency throughout the life of the project.

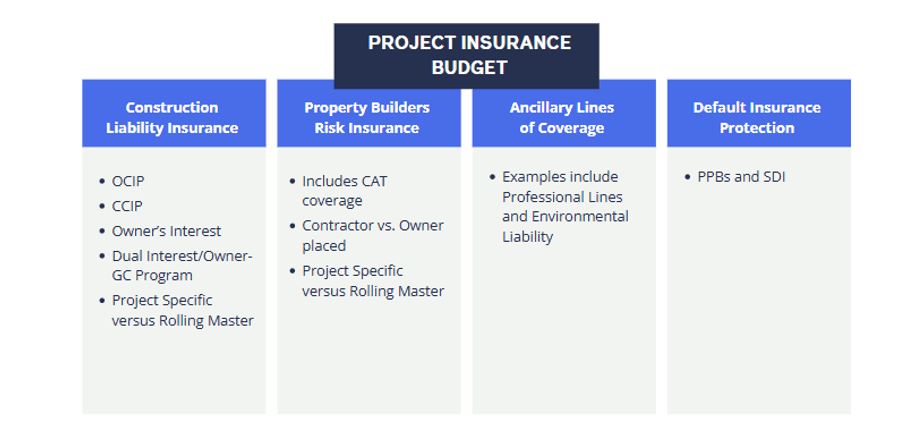

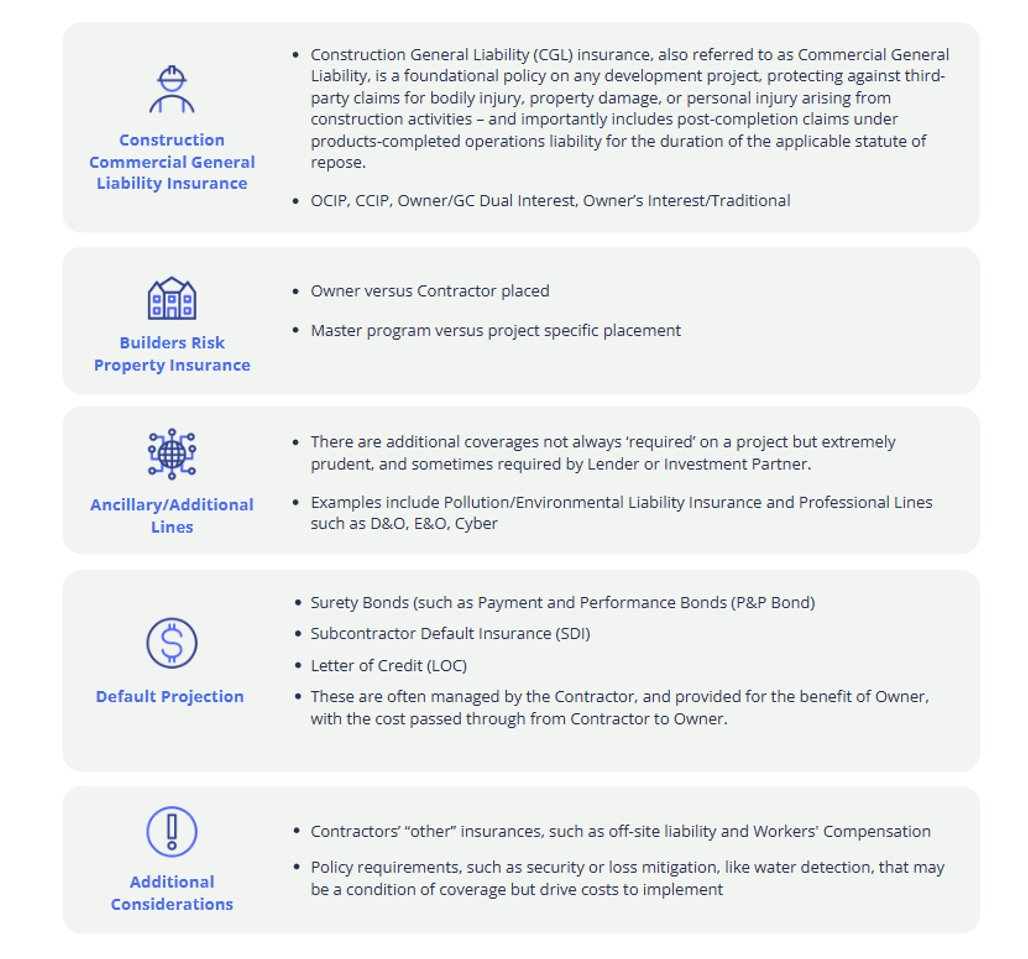

The Breakdown

The following outlines key insurance coverages and associated considerations that contribute to a project’s TCOR—whether placed by the owner, contractor, or another involved party. Regularly reviewing these policies, including those maintained and charged by the general contractor, is essential for helping ensure adequate financial protection and a well-balanced risk strategy.

What’s not reflected in the visual, but is equally critical, are the underlying conditions and compliance obligations within the policies themselves. These may include site-specific requirements (e.g., security measures, lighting, fire protection systems) that, if unmet, could restrict or even void coverage.

In addition, deductible obligations in the event of a loss, often as high as 5% of the project’s insurable value, must be clearly understood and budgeted for, including clarity around which party bears responsibility for payment. Finally, in addition to the “big” project-level policies placed by the developer or contractor, all contractors and subcontractors are required to carry their own coverages (e.g., Workers’ Compensation, Auto Liability). These costs are typically passed through the GMP, and while often embedded, they represent a meaningful component of the project’s overall Total Cost of Risk—and should not be overlooked.

Tailoring Streamlined Solutions

The best way to help manage your project’s Total Cost of Risk and avoid coverage gaps is to work with an experienced team that understands the complexities of construction insurance. The Baldwin Group is committed to delivering tailored risk management strategies and insurance solutions that align with your project’s financial and operational objectives.

Connect with our construction experts today.

For more information

We’re ready to help when you are. Get in touch and one of our experienced Baldwin advisors will reach out to have a conversation about your business or individual needs and goals, then make a plan to map your path to the possible.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.