The term “captive” has been a buzzword in the risk management community for quite some time. Captives can provide a mechanism to better manage the risks within an organization’s construction operations, and contractors big and small often ask us to help them to better understand them. Let’s take a look at one of the fast-growing forms of captive insurance companies: the Group Captive.

What is a group captive?

A group captive is an insurance company that is wholly owned and managed by its insureds with a primary purpose of insuring the risks of its members.

The three pillars

Performance-based pricing

The membership sets the underwriting guidelines of the captive and decides what risks they are willing to insure. Premium rates are developed based on the actual claims experience of the members with greater emphasis on the member’s individual claims performance.

Transparency and control

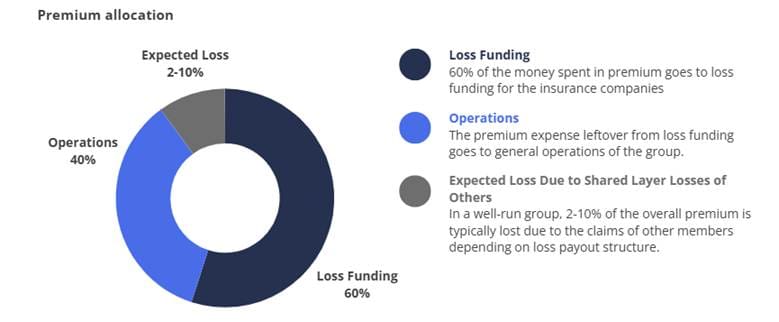

Members of the captive benefit from full transparency of their premium spend and their claims outcomes. The member has full visibility into how every dollar of their premium is allocated and maintains greater control by providing more direction in the claims process.

Financial return

Underwriting profitability gets distributed back to the members in the form of dividends, rewarding superior claims performance and incentivizing members to prioritize risk management and safety within their organization.

What are some other advantages of group captives compared to the traditional insurance market?

Stability – While the traditional insurance market is cyclical in nature, members often find that the group captive structure provides greater long-term stability in terms of the rates, terms, and conditions that govern their insurance program.

Benchmarking – Contractors are inherently competitive. The controlled and transparent nature of a group captive provides a means to benchmark your organization’s risk management, safety, and claims performance against other contractors.

Knowledge sharing – Group captives provide a forum for contractors to share ideas, experiences, strategies, and lessons learned in a way that doesn’t jeopardize their unique value proposition. One of the common themes we hear from group captive members is that the peer group that develops within the captive members makes them a better, safer, more efficient organization.

The captive structure

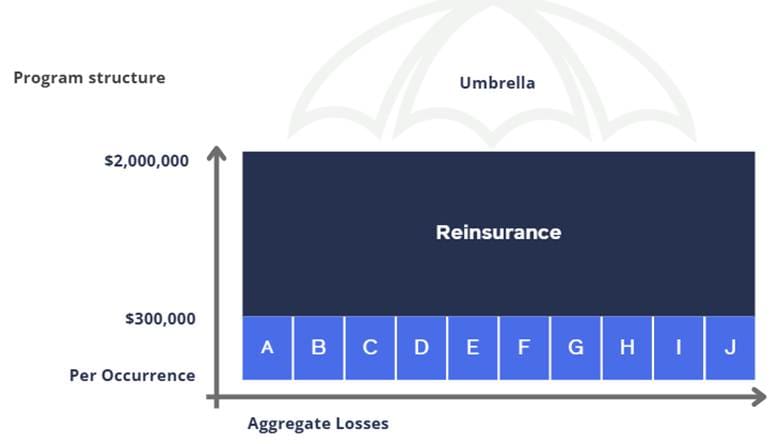

Goals of the group captive

- Fund for expected losses

- Purchase reinsurance for catastrophic claims

- Each company pays for their own claims

- Minimize risk sharing

For more information

We’re ready to help when you are. Get in touch and one of our experienced Baldwin advisors will reach out to have a conversation about your business or individual needs and goals, then make a plan to map your path to the possible.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.