We are often asked by project owners “What are the options and considerations when determining how best to insure third party liability risk on a construction project?”. The intent of this document is to outline the various alternatives and evaluate the pros and cons of each.

Traditional insurance

Under this scenario, the owner needs to secure liability coverage for their own vicarious liability. Historically, this was often secured through the owner’s corporate general liability policy, but that coverage may or may not be available in today’s market. In its place, the industry has developed an Owners Interest Liability product specifically designed to provide protection to the owner of a construction project. The Owners Interest Liability policy can be structured on a project-specific basis and provide coverage for the duration of the project through the statute of repose. The policy will likely have contractor warranty provisions that obligate the owner to include certain contractual requirements from their direct contractors to ensure proper risk transfer.

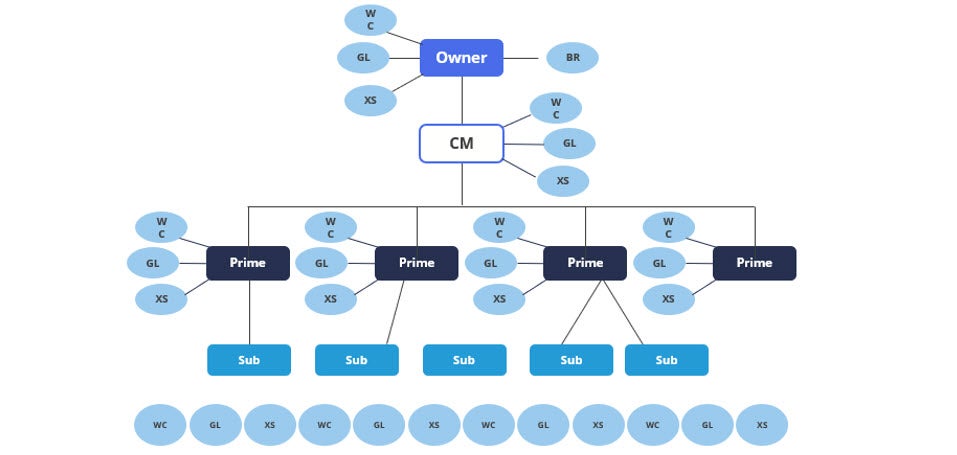

Traditional insurance procurement is the easiest method to understand, as it has historically been the conventional approach to insuring projects. The project owner hires a general contractor who then hires various subcontractors, and each party is contractually required to maintain certain types and levels of insurance. The objective is for the owner to transfer as much of the construction risk as possible down to the contractor(s). In their contract with the general contractor, the project owner will outline the types and amounts of insurance required and require the contractor (and their subcontractors) to provide them with a waiver of subrogation, as well as additional insured status on a primary and non-contributory basis under their policies. The contract will also include defense, indemnity, and hold-harmless provisions that protect the owner from liability arising out of the construction to the extent allowed by law.

Benefits

- Easy to understand and support internally

- If structured properly, risk is ultimately transferred to the negligent party(s)

- The owner has no long-term deductible or collateral obligations, which allows them to financially close the project out soon after construction

- The cost to the owner is not impacted by claims activity on the project

Disadvantages

- Each party brings their own insurance, which often means multiple insurers are involved on claims. This can lead to costly cross-litigation amongst the parties involved.

- Each contractor policy will have different policy limits and varying degrees of coverage and may be subject to onerous policy exclusions. The owner may not truly know how the contractor’s policy will respond until a loss occurs.

- While the goal is for the owner to transfer the risk in its entirety, there are legislative challenges at play. Each state has varying anti-indemnity statutes that dictate how much of the risk can legally be transferred down in a construction contract. Some states have even adopted the horizontal exhaustion standard, where an owner’s general liability policy may be forced to respond to a catastrophic claim before their contractor’s umbrella policy.

- The owner often does not have visibility into the cost of insurance that is embedded in their contractors’ contract values.

- With traditional insurance policies only being secured in 12-month increments, there is uncertainty around the availability of coverage from the contractors after construction is complete. In many states, claimants can bring a suit for as long as ten years after the project is complete.

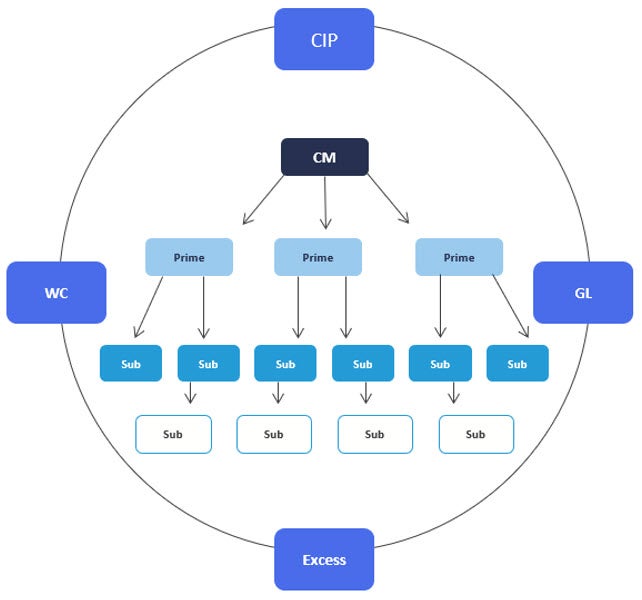

Consolidated Insurance Programs (CIPs) – aka wrap-ups

There are various types of Consolidated Insurance Programs (CIPs – aka wrap-ups) available in the marketplace. While all are designed to provide a more efficient means for insuring construction projects, each program type has its own unique characteristics, benefits, and limitations. What might be an optimal fit for one project, may not be practical or even available on another. Allow us to provide an overview of the different types of CIPs.

First, we must identify the type of coverage provided by each program. Under a Two-Line Wrap-Up, the enrolled parties are provided Worker’s Compensation, General Liability, and Umbrella/Excess Liability coverage. These programs are often written by standard markets on admitted paper and feature large deductibles/retentions. The owner’s deductible exposure is typically limited by an “aggregate cap”, which represents the maximum dollar amount a sponsor will be required to pay out of pocket for claims within their deductible during the program term. Depending on the type of retention selected by the insured, collateral in the form of letter of credit, cash, trust, or bond is often required by the insurer.

As the name suggests, a monoline or “GL-Only” CIP provides only General Liability and Umbrella/Excess Liability coverage. The enrolled parties are expected to maintain their own on-site Worker’s Compensation coverage along with other typical insurance requirements. While a GL-Only CIP may be structured on a large retention program, the majority feature a retention of $100,000 or less and typically do not require collateral. These programs may be written on an admitted or non-admitted basis.

In either scenario, an owner purchasing an OCIP has control over the insurance on the project simply by making the purchase and becoming the “sponsor” of the wrap-up. Insuring all the contractors under the same program minimizes the impact of anti-indemnity statutes and the exposure to costly cross-litigation. They also gain economies of scale, which affords the ability to secure higher quality, tailored insurance coverage at a competitive cost. Lastly, they also benefit from greater cost and coverage certainty during the lifecycle of the project through the statute of repose.

Two-Line OCIP’s

By purchasing a Two-Line OCIP, the owner is looking to benefit from the risk/reward dynamic that comes with a higher deductible plan. The two-line program maximizes the owner’s opportunity to enjoy lower insurance costs on the project through a combination of factors. Not only are all eligible contractors instructed to remove the costs of their OCIP-provided insurance from their contract cost during the bid stage, but the large deductible structure affords the owner the opportunity to drive further cost savings through proper investment in jobsite safety and claims management. If the project is large enough, the maximum cost of the OCIP often closely aligns with the cost of traditional insurance, providing little downside risk to the owner. Of course, if contractors don’t bid correctly, loss prevention is not a significant initiative and if claims aren’t managed effectively, the anticipated savings can quickly dissolve.

Benefits of a Two-Line Wrap-Up

- Greatest opportunity to minimize overall insurance cost on the project

- Cost and coverage certainty through the lifecycle of the project

- Minimized exposure to cross-litigation between stakeholders in the project

- Can broaden subcontractor pool by including MBE/WBE/DBE firms that could not otherwise purchase the required insurance protection

Disadvantages of a Two-Line Wrap-Up

- Highest administrative burden and may require dedicated internal resources to manage enrollments, claims, safety, payroll reporting, etc. While the owner may be able to pass some of the administrative burden down to the GC, we often see GC’s charge a fee for this responsibility.

- Owner, as the program sponsor, assumes deductible responsibility and long-term collateral obligations, which extend well beyond completion of the project

General Liability “GL-Only” OCIPs

Many owners opt for a GL-Only program as it provides many of the same advantages of the two-line program but without the obligations that come with a two-line wrap up. The GL-Only OCIP still brings cost and coverage certainty to the project and can reduce cross-litigation exposure. However, removing Worker’s Compensation from the OCIP greatly reduces the administrative burden to the owner, as enrollment is more streamlined and claims are far less frequent.

There are a few downsides to consider associated with GL-Only programs. With the lower deductible structure, there is less opportunity to drive cost savings on the project. Most owners who purchase GL-Only programs do so with coverage certainty in mind as opposed to maximizing their opportunity to minimize cost. There is also often a learning curve for owners about what to expect in terms of subcontractor credits. Owners often want to avoid administrative burden as much as possible but must balance this with the desire to drive the highest credits possible from their bidding contractors. Another consideration is that these programs are often written through the Excess & Surplus lines market by insurance companies that typically lack the deep claims and loss prevention resources that their peers in the standard market often employ. Of course, your broker also plays a critical role in providing technical coverage expertise, as these policy forms are often customized and unregulated.

Other options for project owners:

Owner GC project-specific program

Another solution for owners to consider is an owner/GC program where the owner and the general contractor are both named insureds, but the subcontractors bring their own insurance to the project. These owner/GC placements are written on a project-specific basis and provide the owner and general contractor with comprehensive general liability and umbrella/excess liability coverage. While both parties are named insureds on the policy, the owner is typically the first named insured and maintains responsibility for the premiums, deductible payments, and adherence to policy conditions. Similar to an Owners Interest policy, there is generally a subcontractor warranty endorsement added to the policy that obligates the subcontractors to satisfy certain minimum indemnification and insurance requirements in their contract with the general contractor. As such, a satisfactory review of the general contractor’s standard subcontract and their subcontractor prequalification and management program is an important element of the underwriting process.

There are a few disadvantages of these placements as compared to wrap-up programs. Since subcontractors are not insureds under the policy, anti-indemnity statutes do come into play and there is still an opportunity for cross litigation – particularly between subcontractors. The policy also must be carefully reviewed and modified to remove troublesome exclusions that could prohibit coverage for certain property damage claims, as well as cross suits between the named insured parties. An experienced construction insurance broker will carefully negotiate the policy modifications to avoid a coverage gap but not all brokers are well versed in this area. Lastly, insureds must always be careful to review how the policy responds in the event that the subcontractor warranty provision endorsement is triggered. Some policies will impose a higher deductible if the general contractor hires a subcontractor who does not meet the minimum requirements but there are coverage forms out there that impose a “hammer clause”, which excludes coverage in its entirety if the non-compliant subcontractor is negligent.

Contractor Controlled Insurance Program

Given all these options available to a project owner, why might they instead prefer to authorize the general contractor to purchase a Contractor Controlled Insurance Program (CCIP)? Simply put, the owner can benefit from many of the advantages of an OCIP without any of the financial or administrative burden.

With a CCIP, the contractor assumes the deductible obligation, the long-term collateral requirement, and the ultimate responsibility for investment in site safety. The contractor also undertakes the responsibility for claims reporting, management, and mitigation. Essentially, the Contractor takes on the risk of the project, but ownership can still benefit from broad coverage that is guaranteed through the statute of repose. From a cost standpoint, the CCIP should be equivalent to, or even less expensive than, traditional insurance since the general contractor is leveraging economies of scale in the marketplace.

Benefits of a CCIP to the owner

- Broad coverage that can be tailored to the project

- Cost and coverage certainty through the lifecycle of the project

- Minimized exposure to cross-litigation between stakeholders in the project

- Coordinated accident/claims response

- Minimal administrative burden to the owner

Disadvantages of a CCIP to the owner

- Owner may be able to negotiate a CCIP price equivalent to (or slightly lower than) traditional insurance but is forgoing the ability to benefit from favorable claims experience on the project

- On the surface, a CCIP may seem more costly than traditional insurance unless the owner has visibility into the subcontractor insurance costs that get removed from their contracts

- Owner may not be afforded the ability to be added as a named insured under the program, meaning they would only be provided coverage for claims that arise out of the contractor’s operations. For their own vicarious liability, an Owners Interest policy may be necessary (and would add further cost to the project).

- In the event that the owner terminates the general contractor, the owner likely has to find a new insurance solution for the remainder of the project. This creates significant challenges from a cost and coverage perspective.

If you are a project owner and would like to learn more about the insurance options for your upcoming project, please reach out for more detail.

For more information

We’re ready to help when you are. Get in touch and one of our experienced Baldwin advisors will reach out to have a conversation about your business or individual needs and goals, then make a plan to map your path to the possible.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.