OVERVIEW:

The Public D&O Market through 2023 continued to be driven by basic principles of supply and demand economics. The supply of D&O capacity remains robust, after capacity expanded rapidly with new entrants pursuing elevated premiums/retentions from the recent hard market. Demand, however, remains depressed with limited capital market activity in 2023 to drive demand via the creation of new public companies. The excessive supply continues to push insurance companies to compete over existing public business, in turn driving down rates and retentions for insureds.

2023 MARKETPLACE TRENDS:

Pricing: After an abrupt shift to soft market conditions in the second half of 2022, the D&O marketplace remained highly favorable for most insureds throughout 2023. Both newly public (within the past three years) and existing public company insureds continued to secure material premium and retention reductions across their D&O programs. For newly public companies, premium cuts were typically north of 35 percent – 40 percent, while older public insureds experienced more muted but nevertheless meaningful decreases (20 percent+).

Capacity: Insurance capacity remains readily available across the D&O space, with slower capital markets activity continuing to limit new public company business for insurers. The influx of new domestic D&O capacity on the back of the hard market, along with London’s re-emergence in the U.S. marketplace, has also served to drive more favorable buying conditions for insureds.

Terms & Conditions: Insurance companies remain flexible on terms/conditions and have continued to expand their risk appetites. In particular, companies remain willing to reduce retentions and broaden coverage terms as ways to differentiate in a crowded marketplace. Insureds should partner with a strong brokerage team to secure the broadest coverage available in the marketplace.

2024 PROJECTED MARKETPLACE TRENDS:

As we move into 2024, we expect to see some deceleration in rate decreases for most insureds. While decreases will remain available, we anticipate insurers will take a more cautious approach across D&O business as they assess overall portfolios following two years of aggressive rate reductions. That said, absent a material change in broader financial conditions to drive new IPO or M&A opportunities, we expect D&O capacity to remain stable, abundant, and competitively priced for 2024.

SCA FILINGS TRENDS:

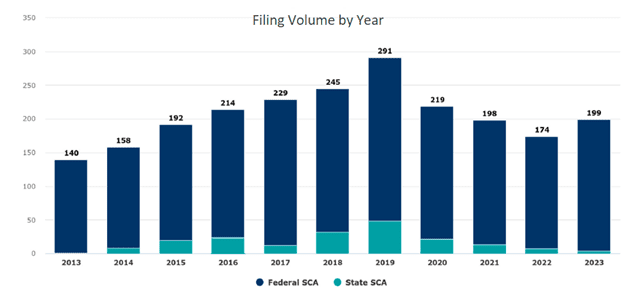

Securities Class Action (“SCA”) filings increased modestly to 199 in 2023, after falling each year since the peak of 291 filings in 2019. The Healthcare industry maintained the highest volume of filings (43) throughout 2023, but filings in the Financials Industry grew most significantly year/year. Specifically, Financials industry filings nearly doubled in 2023, driven largely by uncertainty across the banking sector.

KEY TAKEAWAYS:

- While healthcare remained the most targeted industry class in 2023, the 43 filings represented the lowest number of suits since 2015.

- Although the creation of new SPAC vehicles has slowed, SPACs remain a concern. 22 SCA Filings in 2023 involved a SPAC or recent DeSPAC transaction.

- Most common sources of SCAs included misstatements around operations problems and missed earnings/performance projections.

- Only 15 SCAs in 2023 involved misstatements made during an IPO process, with an additional three suits brought in State court. Total IPO suits are down materially from prior years and reflect the tepid capital markets environment through 2023.

Source: Stanford Securities Litigation Analytics

2023 SCA SETTLEMENT TRENDS:

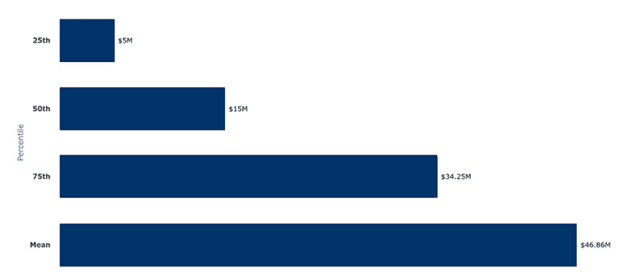

- The Aggregate Settlement Amount for cases settled in 2023 was $3.9B. The top 4 settlements, out of 83 total settlements, accounted for 50 percent of the aggregate settlement amount.

- The median settlement value increased for the 3rd straight year to $15M. This increase follows a median settlement value of $13.5M in 2022 and $9.5M in 2021.

- The Healthcare industry continues to lead all industries with regard to SCA settlements each year over a 4-year period.

2023 Distribution of Settlement Sizes

Source: Stanford Securities Litigation Analytics

WHAT TO WATCH FOR IN 2024: THE UNDERWRITERS‘ PERSPECTIVE:

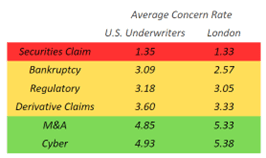

We surveyed over 100 underwriters across the public D&O marketplace to get their thoughts and concerns heading into 2024.

Here are the Underwriter’s responses to the following risk/exposure concerns for 2024:

When underwriting, please rank these claims in order of concern. (1 being most concerned and 6 being least concerned)

Top 5 underwriter questions going into 2024:

- Cyber/SEC disclosure

- Capital costs/rates/economy

- 2024 elections and geopolitics

- ESG

- AI

Observations:

While there are a lot of questions relating to cyber and the new SEC guidelines, there is not yet a corresponding level of concern as the claims trends have yet to follow the level of questions.

Bankruptcies continue to be an area of focus for underwriters, especially as we continue to operate in a high-interest-rate environment, with limited access to new capital for many companies.

There are still concerns related to derivative suits filed against public companies. While frequency has trended down since 2020, severity has increased. 2023 saw settlements in several high-profile derivative actions, with those settlements ranging from $85M to $735M.

US Based Underwriters:

US Based Underwriters:

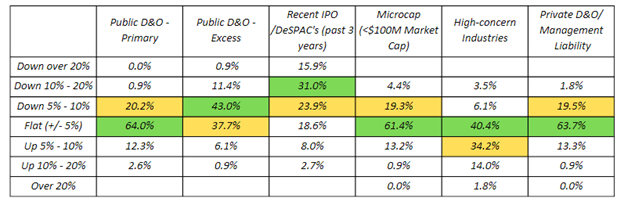

(Green most popular | Yellow second most popular)

Observations:

- The market is still projecting modest rate decreases (0 percent – 10 percent range) for traditional existing public co-placements.

- Excess rates are projected to have slightly greater decreases than primary.

- London has, and is projected to continue to have even greater rate flexibility with recent IPOs & DeSPACs.

- High-concern industries (i.e., Crypto, Cannabis, etc.) are the only category projecting overall slight rate increases.

Industry Heat Maps:

Observations:

- Bitcoin and crypto continue to be perceived as the most risky. We believe that is because there are no federal mandates.

- SPACs are perceived as less risky than in the past because they are more commonplace. Also, the universe of SPACs has decreased significantly, which reduces this concern. It’s an interesting dynamic where London sees SPACs as riskier than the U.S., but also seems to be projecting greater rate decreases on recent IPOs and DeSPACs. We suspect this is because London was probably at the higher end of the rate spectrum when the IPO/SPAC/DeSPAC program was initially placed during the 2020 and 2021 boom.

- Healthcare is still the leading industry sector for SCA’s, which leads to underwriters concerns. However, the number of claims filed against Healthcare companies has trended down over the last three years.

- The banking sector reflected a significant increase in SCA’s over the past three years which correlates to increased risk perceptions. Many of the 2023 SCA’s relate to the recent bank failures or banks that had similar risk profiles as those banks that failed.

SEC GUIDELINE ON CYBER DISCLOSURES:

The cross-section of cyber into the Boardroom

In 2023, the SEC provided new regulations regarding mandatory disclosures of material cyber events and annual disclosures of cyber risk management and governance provisions.

Specifics:

When: Public companies must provide the required cybersecurity incident disclosure within four business days after the company determines the incident to be material. The deadline is not four business days after the incident occurred or is discovered.

Why Four days: This timing is consistent with the reporting of other events the Commission requires to be reported on a Form 8-K, such as entry into or termination of a definitive material agreement or a bankruptcy. If the company does not know all the information required to be disclosed four business days after a materiality determination, the final rule contains a mechanism for the company to disclose that information in a subsequent filing.

Why use a ‘Material’ threshold: Materiality is a standard of securities laws. It connects disclosures back to the needs of investors.

Potential Exposures/Liabilities:

Materiality – What constitutes materiality in the context of a cyber incident? The SEC continues to abide by its familiar standard for materiality across the Federal securities laws: an incident is material if there is a substantial likelihood that a reasonable investor would attach importance in determining whether to buy or sell the securities in question.

Over-reporting – The company discloses every cyber incident because of tight four-day requirement and uncertainty on materiality. Understanding that forensics can take much more than four days if the severity of the cyber event ends up being much more severe in comparison to what was initially reported, there could be accusations of downplaying the event with the initial disclosed.

Under-reporting – The company determines on its own accord that the breach is not deemed ‘material’ only to be out of compliance with the regulation months later when the ramifications of the breach are disclosed.

Risk management disclosures – There could be a scenario where a company experiences a significant cyber event, and the plaintiffs’ attorneys will go back and allege that the Risk Management Disclosures include false assurances that the company was safe against that type of incident and/or overstated the extent to which the company had a process to protect against such an event.

WHAT TO WATCH FOR IN 2024:

- New regulatory developments and D&O impact:

- SEC cyber disclosure rules, mandating timely disclosures of material cyber incidents

- SPAC rules updating required disclosures in SPAC/DeSPAC transactions.

- Financing and access to capital continue to remain critical for insurers, as we continue in a prolonged elevated interest rate environment.

- Impact of Artificial Intelligence across business operations, including any associated market disclosures.

- ESG remains an important topic, including upcoming SEC rulemaking around climate change disclosures.

- Event driven litigation remains prevalent; Recent litigation drivers included geopolitics, interest rates, wildfires, and lead cables.

- Continued stress in the banking sector may adversely impact smaller regional financial institutions.

For more information, email The Baldwin Group Management Liability Practice: ManagementLiability@baldwinriskpartners.com Or, visit our webpage.

For more information

We’re ready to help when you are. Get in touch and one of our experienced Baldwin advisors will reach out to have a conversation about your business or individual needs and goals, then make a plan to map your path to the possible.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.