Introduction

Pharmacy benefits continue to scale out of control. With 70 percent 1 of U.S. adults now taking prescription drugs, last year the United States spent $603 billion on medicines.2 Even more significantly, the Centers for Medicare and Medicaid Services expect that prescription drugs will grow to be the fastest-growing healthcare category over the next decade and outpace other areas of health spending.

Facts and stats 3

- The highest spending occurs with meds that treat diabetes, cancer, autoimmune conditions, and respiratory diseases

- Brand-name drugs make up 80 percent of the money spent on medicine in the U.S.

- Humira, a biologic that treats inflammatory conditions, such as rheumatoid arthritis, psoriatic arthritis, plaque psoriasis, and Crohn’s Disease, generated $14.4 billion in just 2023 alone.

- Among developed countries, the U.S. has the highest per-capita pharmaceutical spending, which is mostly due to higher drug prices.

Prices continue to climb

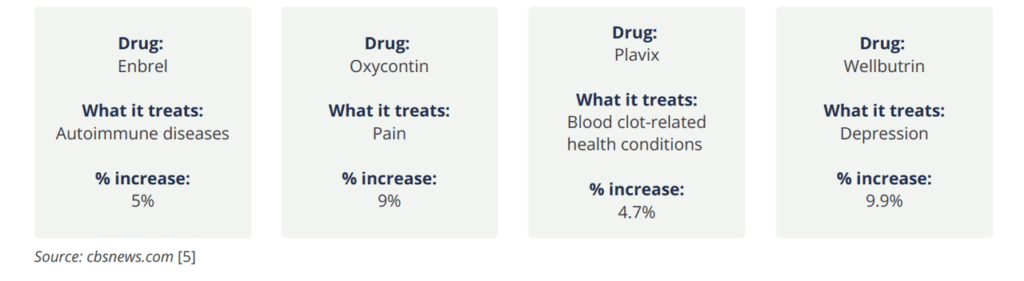

According to the ASPE Office of Health Policy, from January 2022 to January 2023, more than 4,200 drug products had price increases.4 Forty-six percent of the increases exceeded the rate of inflation and averaged $590 per drug. And rates are still forecasted to climb for at least 700 commonly used medications in the coming year.

Expected % increases for Rx drugs (2024)

Employers and employees feel impacts

Rising prescription drug costs are a leading concern for large employers, according to a survey by the Business Group on Health.5 Almost all (92 percent) said they’re concerned about high-cost drugs under development, and more than 90 percent are worried about pharmacy cost trends overall.

Efforts by the federal government and others to mitigate runaway increases have not begun to slow the upward trend. The majority of Americans now believe the cost of prescriptions are “unreasonable.” Whether they suffer from diabetes, high blood pressure, or arthritis, employees are often forced to make difficult choices when they can’t afford their prescriptions to treat their conditions. And that means conditions can worsen, creating unhealthy worker populations and increasing costs for everyone.

“The majority of Americans now believe the cost of prescriptions is unreasonable.”

-Peterson KFF Health System Tracker 6

Why are costs out of control? And what can employers and health plan sponsors do to reverse trends? Understanding the key factors driving prescription drug costs is the first step to finding effective solutions for reining in prices.

In this whitepaper, we’ll examine evolving trends related to pharmacy benefits and explore cost containment strategies that can help employers and health plan sponsors get a better grasp on the situation and move forward.

Evolving trends in pharmacy benefits

There is a myriad of reasons tied to escalating prescription drug costs. Benefits experts cite patent issues, chronic health conditions, specialty drug development, an aging U.S. population, supply and demand issues, and expensive gene therapies as just a few of the evolving trends that contribute to the seemingly never-ending rise in cost and utilization.

Here’s a closer look at each one.

Patent extensions

Typically, a drug patent covers the makeup of a drug and/or the production process required to create it for a given time. But when the patent nears expiration, drug companies often extend their protection (usually by changing a tiny aspect of the formula), which can delay competition, obstruct the development of generic (cheaper) versions of the drug, and keep the cost of the medicine excessively high.

“Patent monopolies on seven out of 10 of America’s top selling drugs should expire this decade. This means drugmakers stand to lose billions if—and when—lower-priced generic alternatives are allowed on the market.”

-Time Magazine 7

As soon as next month, patents on some commonly used medications will expire, allowing generics and alternatives to brand-name drugs to enter the market. And while that can offer the potential for prices to come down, it may not happen immediately.

If drug manufacturers offer rebates for the brand name version, those can lower them to the same level as (or lower than) a generic version. So, there could be less impetus for other players to move quickly to develop less costly alternatives, continuing the elevated price levels.

Expiring patents

Popular prescription medications coming off patent in 2024

More new drugs

On the flipside, new drugs that can treat rare and debilitating diseases are getting approved and coming to market more than ever before. While these new drugs offer hope to patients, the cost can be exorbitant.

“The cost of bringing a new drug to market is approximately $5 billion and can take nearly 15 years.”

-Financial Express Healthcare 8

So while prices can drop on a number of drugs coming off patents, as mentioned in the section above, there are still other, more expensive ones, that can potentially take their place—and effectively keep costs high overall.

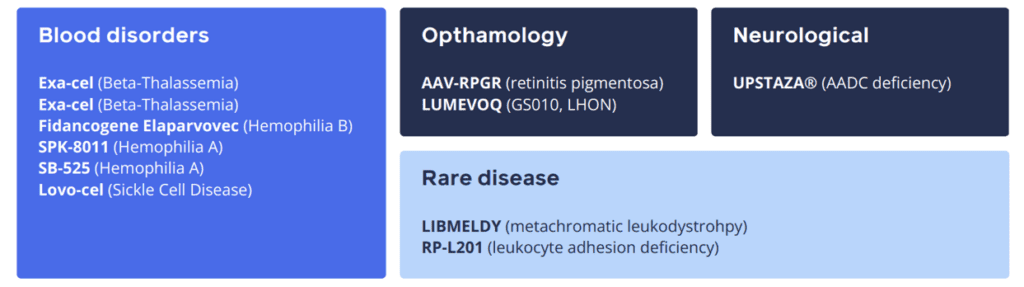

New therapies nearing FDA approval

Last year the median list price for a single new drug was $300,000, up from about $220,000 in 2022, and $180, 000 in 2021.

-Reuters 9

Glucagon-like peptide-1 (GLP-1) medications

According to Trust for America’s Health, obesity rates in the U.S. over have steadily climbed over the past two decades. As of September 2023, almost 42 percent of the population is considered obese. 10

Obesity is associated with a range of diseases, including type 2 diabetes, heart disease, stroke, arthritis, sleep apnea, and some cancers. Left untreated and unmanaged, the condition is estimated to increase U.S. healthcare spending by $170 billion per year, adding to health plan costs for employers.11

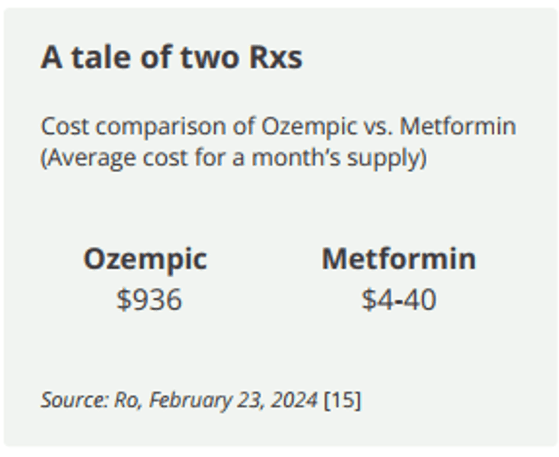

The development of GLP-1s, like Ozempic, indeed offer an effective weight loss option for obesity and to get diabetes under control. With the increasing popularity and efficacy of this type of medication, it’s not surprising that many employees now seek coverage for GLP-1s from their employer-sponsored health plans. According to Becker’s Hospital Review, even the American Diabetes Association changed its guidelines and now recommends Wegovy and Ozempic as the preferred treatments for type 2 diabetes.12

However, these drugs come at a price. Just a four-week prescription of Ozempic, for example, can cost almost $1,000 while the previous protocol, Metformin, runs significantly less.

Supply and demand are also affecting anti-obesity medications (and other specialty drugs). In fact, drug supply shortages hit a ten-year high in the first quarter of 2023 and continue to climb.

While high cost and low supply may prevent employers from covering these drugs, there is a potential to improve talent recruitment efforts and employee retention for those employers that do. The Society of Human Resource Management reports that HR decision-makers feel it will create a better health insurance package overall for employees, as well as give a boost to overall employee satisfaction.13

Innovative gene therapies

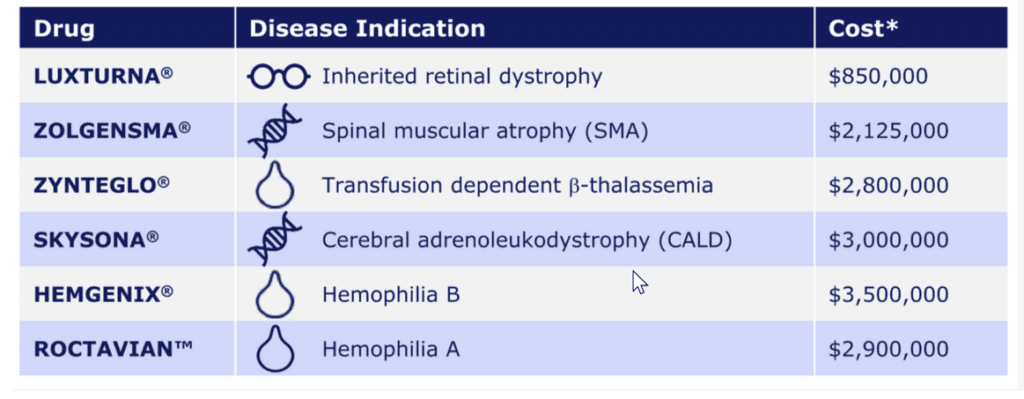

Cell and gene therapies can treat serious health conditions, like hemophilia, muscular dystrophy, and sickle cell disease (SCD), for instance, by correcting DNA and giving hope to those with these conditions.

The cost for these therapies, however, can exceed $3 million per dose, which could be catastrophic for employer-sponsored health plans. And there is usually special care required before treatment and monitoring after treatment that must be given at specialized centers with trained clinicians, which ratchets up the cost of these therapies even further.

2023 gene therapies included:

Image Source: Cigna14

“IQVIA Institute for Human Data Science expects that 55 to 65 cell, gene and RNA-based therapies will launch globally by 2027, and U.S. spending [on these therapies] could rise to $12 billion.”

-Managed Healthcare Executive15

PBM tactics

The ethics of pharmacy benefit managers (PBM) that generally control drug benefits for health plans have been cited as another cost driver. According to American Pharmacies, a co-op of independent pharmacists, “PBMs claim to drive down drug costs by leveraging purchasing power and negotiating with drug makers and pharmacies. However, [they] routinely fail to pass along savings… [and] operate in relative secrecy, while consumers, providers and State/federal government have little information on whether [they] actually reduce drug costs.”16

A recent survey published by Formulary Watch said U.S. employers were not confident in PBM practices —and more than half (51 percent) have questions about their integrity and administration.17

Sixty-three percent

of Americans think PBMs operate with little-to-no price transparency.

Sixty-nine percent

of Americans think PBMs overcharge.

Older, less healthy population

Even though the average life span of Americans is about 77.9 years, a recent Deloitte report calculated that only 85 percent of those years are spent in good health.18

Six in ten Americans live with at least one chronic disease, like heart disease and stroke, cancer, or diabetes..19 Not only are these diseases among the leading causes of disability (and death), but they are also a leading driver of health care costs since, among other things, they increase demand and utilization for drugs that can treat them.

“About six in ten adults say they are currently taking at least one prescription drug. One quarter say they take four or more.”

-KFF 20

Limited cost sharing

The war for talent catapulted the importance of keeping employees happy and healthy as a top priority for employers. An important way of keeping them satisfied is by offering comprehensive benefits packages that today’s employees want and need. At (or very near) the top of their list is health insurance.

But aside from getting access to the benefits they want, employees want affordability. In the last 10 years, the balance to share cost increases between employers and employees has shifted. Today, employers pick up a greater share rather than pass them on to employees, further escalating their overall benefits costs.

“Employers have been trying to avoid passing increases on to workers for about five years, fearing employees could hit a tipping point when it comes to out-of-pocket spending.”

-Axios21

Actions that can help manage cost increases for prescription drugs

With prescription drug utilization only expected to rise, opportunities exist for benefits advisors to help employers navigate evolving trends and manage escalating costs for pharmacy benefits in health plans.

Key opportunities:

Identify employee demographics by using advanced data analytics, paired with AI learning, to not only better understand utilization trends, but also ensure that data drives ongoing strategy and plan design to improve cost management, health outcomes, and overall population management.

Examine PBM contracts to drive much-needed transparency by:

- Carefully reviewing definitions, guarantees, and exclusions to ensure there’s no misunderstandings for employers or their plan members.

- Helping enforce terms for third-party oversight, with unbiased auditing, to ensure contract adherence, identify claims errors, and uncover overpayments.

- Evaluating rebates to find out how PBM manages the formulary to the lowest net cost—and help ensure PBM passes drug formulary rebates to the employer or health plan sponsor.

- Understanding how high-cost specialty drugs are managed (e.g., refills, employee support/educational programs). For example, do they confirm shipment is needed before shipment occurs to avoid drug stock piling?

Study pharmacy arrangement options, like PBM carve-outs, by asking key questions, such as:

- Does an employer need more flexibility in formulary design?

- What level of clinical expertise/clinic programming is offered?

- How much disruption will occur for employees if a new arrangement is adopted?

Decide on a strategy for generics that’s based on a mix of pharmaceuticals, doesn’t rely on name brands, and includes low-cost generics, biosimilars, and cheaper alternatives that work the same way more expensive ones do — and still provide best outcomes.

“Generic drugs contain the same active ingredients at the same strength and purity as their brand-name counterparts but come at a fraction of the cost.”

-Association for Accessible Meds22

Consider weight-loss support that complements the growing utilization of GLP-1 drugs to encourage healthy eating habits, exercise programs, and behavioral health services to help ensure employees remain healthy, and more importantly, don’t relapse — and waste the money spent on these expensive drugs.

Advocate step therapy, which requires employees to try lower-cost options first. But if they fail to work, then an employee can “step up” to a more expensive or brand name drug designed to treat the same condition. This approach can be especially relevant for helping to manage utilization for costly biologics, for instance, but not completely eliminate access.

Map out the plan’s exposure to gene therapy and explore opportunities for payment arrangements and stop-loss solutions that help employers share the financial burden, as well as answer key questions, such as:

- What limits are there for each option? For example, cost thresholds per-patient, the number of therapies covered per-year, etc.

- Will new gene therapies be covered in the future, and if so, how? And how will any of the new coverages affect costs, payments, and renewals?

- How are clinical outcomes monitored and measured? Since employers will be paying for these therapies, it’s important to know how “success” is measured and if they can hold providers responsible if they do not meet it.

- Does it duplicate existing coverage? Employers can seek guidance from their benefits advisors to determine if they pay for gene therapy coverage under an existing stop-loss policy. If they are, they can request a reduction in the premium to avoid paying twice.

Educate employees about prescription drug costs and how their choices affect costs (and savings), such as when they opt for generics instead of brand name prescriptions, or when they use lower-cost sites of care (e.g., infusion centers), mail-order prescription drug wholesalers, or onsite pharmacies.

Design wellness programs that encourage and reinforce healthy habits, enhance overall well-being, reduce instances of chronic illnesses, alleviate stress, lower absenteeism, and increase engagement and job satisfaction, leading to lower healthcare costs — and a happier, more productive workforce.

Finding the right advisor for your needs

Employers will want to tap into a team of experts with a proven track record who can navigate evolving trends with pharmacy benefits. At The Baldwin Group, our benefits advisors help employers carefully analyze options and choose solutions that not only meet strategic goals for both their employees and their organizations, but also offer several distinctive advantages, including:

Exclusive options with preferred partners that allow employers to access prescription drugs at deep discounts from drug manufacturers — often only made available to eligible healthcare organizations — and without disrupting employees’ relationships with their doctors.

Creative solutions through mail order that allow employers (and employees) to benefit from international drug prices, which typically run 278 percent less than in the U.S.23

A “whole person” approach to manage chronic conditionsthat begins with analyzing employee population data then structures programs that can help employees adopt healthier lifestyles and possibly reduce the need for drugs over the long term.

Comprehensive technology to deliver value-based care by integrating the analytics, care management, and payment technology that’s necessary to help organizations and self-funded employers enhance cost and quality outcomes.

As trends continue to impact pharmacy benefits for employers, there remains a need for professional guidance and effective solutions to adapt policies and programs — and manage costs. To learn how we can work together, connect with us today.

More Information

- Evaluating Your Pharmacy Benefit Manager

- Off-Label Use of Drugs for Weight Loss

- Prescription Drugs Coming Off Patent

- Civic Science, “A Growing Number of Americans Report Taking Prescription Medications Daily,” Andrew Gallant, January 11, 2023 ↩︎

- Statista, “Total nominal spending on medicines in the U.S. from 2002 to 2022,” Matej Mikulic, September 15, 2023 ↩︎

- SingleCare, “Prescription drug statistics 2024,” November 29, 2023 ↩︎

- ASPE, “Changes in the List Prices of Prescription Drugs, 2017-2023,” Arielle Bosworth et al, October 6, 2023 ↩︎

- Business Group on Health, “77% of Employers Report Increase in Workforce Mental Health Needs, Says Business Group on Health’s 2024 Health Care Strategy Survey,” August 22, 2023 ↩︎

- Peterson KFF Health System Tracker, “What are the recent and forecasted trends in prescription drug spending?,” Emma Wager, Imani Telesford, Cynthia Cox, and Krutika Amin, September 15, 2023 ↩︎

- Time, “Big Pharma’s Patent Abuses Are Fueling the Drug Pricing Crisis,” Tahir Amin and David Mitchell, February 24, 2023 ↩︎

- FE Healthcare, “Top 10 blockbuster drugs that will become off-patent in 2024,” Sushmita Panda, January 25, 2024 ↩︎

- Reuters, “Prices for new US drugs rose 35% in 2023, more than the previous year,” Deena Beasley, February 23, 2024 ↩︎

- Trust for America’s Health, “State of Obesity 2023: Better Policies for a Healthier America,” September 21, 2023 ↩︎

- Trust for America’s Health, “State of Obesity 2023: Better Policies for a Healthier America,” September 21, 2023 ↩︎

- Beckers Hospital Review, “American Diabetes Association puts Wegovy, Ozempic as preferred treatments,” Paige Twenter, March 6th, 2023 ↩︎

- SHRM, “Here’s How Much GLP-1 Drugs for Weight Loss Are Amounting to in Employer Claims,” Kathryn Mayer, “December 4, 2023 ↩︎

- Cigna, “Embarc Benefit Protection”, 2023 ↩︎

- Managed Healthcare Executive, “Strategies for Paying for Gene and Cell Therapies, 2023 PBMI Annual National Conference,” Denise Myshko, September 7, 2023 ↩︎

- American Pharmacies, “ PBM Issues,” Accessed April 2024 ↩︎

- Formulary Watch, “ Survey Finds More than Half of Employers Not Confident in PBM Practices,” December 13, 2023 ↩︎

- Deloitte, “How employers can spark a movement to help us live longer and healthier lives,” Andy Davis et al, June 20, 2023 ↩︎

- CDC, “Advancing Chronic Disease Practice Through the CDC Data Modernization Initiative,” Timothy Jay Carney et al, November 30, 2023 ↩︎

- KFF, “Public Opinion on Prescription Drugs and Their Prices,” Ashley Kirzinger et al, August 21, 2023 ↩︎

- Axios, “Employers couldn’t duck higher costs of covering workers: survey,” Tina Reed, September 8, 2023 ↩︎

- AAM, “The U.S. Generic & Biosimilar Medicines Savings Report,” September 2023 ↩︎

- Rand, “ International Prescription Drug Price Comparisons,” Andrew W. Mulcahy et al, February 1, 2024 ↩︎

For more information

We’re ready to help when you are. Get in touch and one of our experienced Baldwin advisors will reach out to have a conversation about your business or individual needs and goals, then make a plan to map your path to the possible.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.