“If you’ve seen one government contract, you’ve seen one government contract.”

The construction needs, contracting vehicles, and long-term opportunities presented by the Department of Veterans Affairs (VA) are as unique as the contracting officers soliciting them. Like with any federal agency, a successful contracting relationship with the VA requires a thorough understanding of the agency’s nuances and, at times, complexities. Equipped with the right intel and resources, contractors who master this landscape can find themselves with access to consistent, meaningful construction projects that serve our nation’s veterans.

The construction industry is rapidly evolving, with new technologies and delivery methods emerging almost daily. However, the fundamentals of VA contracting remain rooted in tried-and-true processes designed to ensure fairness, transparency, and value for taxpayer dollars. Understanding these processes isn’t just about compliance—it’s about positioning your firm for long-term success in a highly competitive market. This federal contracting expertise, coupled with a robust and strategic surety team, can tip the scales heavily in your favor.

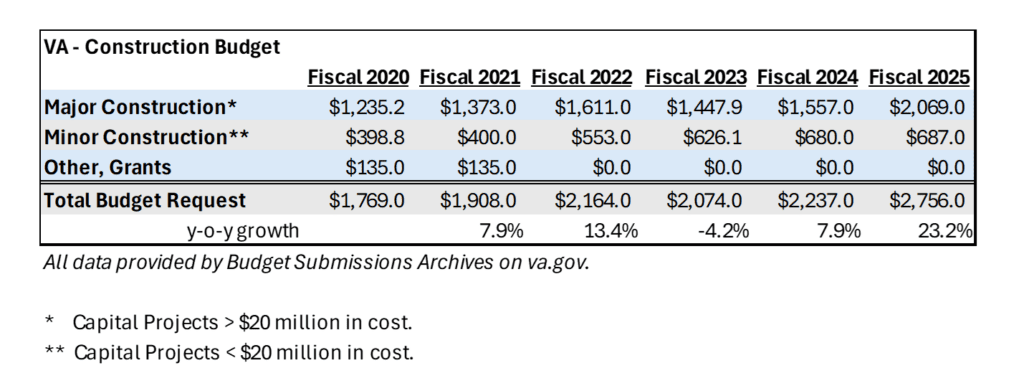

The scale of new business opportunity with the VA is significant. They’ve consistently provided multi-billion dollars’ worth of new construction awards to contractors invested in their partnership. For 2025, the VA’s war chest for construction spending is expected to increase dramatically – by 23% to $2.75 billion. This amounts to roughly $225 million of new VA construction work each month. For historical context, below is a six-year summary of the VA’s construction budget, which demonstrates the growing importance of, and the VA’s commitment to, construction.

The amounts captioned above are invested across the entire U.S. to:

- Build new VA medical centers & VA outpatient clinics

- Renovate/expand the approximately 170 existing VA medical centers and 1,200 VA outpatient clinics. These vital construction projects support the health and long-term success of the nearly 16 million veterans living in the U.S.

Contracting Methods

To play an important role in these vital projects, it’s important to first understand the different contracting vehicles the VA use, and how each method aligns with your firm’s capabilities and goals. The agency employs several contracting methods, each designed for specific scenarios and project types. Four major contracting methods include:

- Sealed bidding is perhaps the most straightforward approach, which operates on a “lowest responsible bidder” (aka “best price”) model. Because best price wins, projects that employ a sealed bidding approach generally are less complex and have a higher degree of certainty in scope. While this might seem simple, these projects require careful attention to detail and a deep understanding of project specifications. There’s no room for negotiation once bids are submitted, making accurate estimating crucial. The VA invites contractors to participate in a sealed bidding opportunity through an Invitation to Bid (ITB) solicitation.

- *Bonding Considerations: Sealed bidding is also known as rip and read bidding. All individual bid amounts are announced publicly on bid day. Because bid results are known quickly, outstanding bid bonds for these projects can be eliminated quickly if the contractor is not low, which can “free up” bid capacity under the contractor’s surety bond program.

- In contrast, the VA’s negotiated procurement projects operate on a best value model. This method evaluates contractors on multiple factors beyond just price—technical competence, past performance, and the contractor’s status as a small business all play a role in the VA’s award decision. Negotiated procurement is a more nuanced approach that rewards contractors who can demonstrate comprehensive value beyond just competitive pricing. This contracting method is generally reserved for more complex projects or those with undefined/uncertain scopes. The VA invites contractors to participate in a negotiated procurement opportunity through a Request for Proposals (RFP) solicitation.

- Bonding Considerations: Because these projects are awarded on a best-value basis, it takes weeks, even months, for the VA to carefully consider how a bidder’s value proposition stacks up against the VA’s award criteria. The VA has about 4 months (120 days) from the bid date to award the contract. Because of this extended time frame, bid bonds for these projects can remain outstanding for quite some time. Contractors should rely on the expertise of their surety advisor to ensure that a smooth, accurate, and timely bid bond reporting process is in force. This reporting mitigates the risk that the “stacking” of long-outstanding bid bonds consumes too much of a contractor’s available bonding capacity.

- In sole source contracting, no competitive bidding is involved, and the VA awards the project directly to one contractor. This contracting method is used in exceptional circumstances, usually involving limited pools of qualified contractors, or a project that requires unique technical expertise. Because the VA bypasses their standard competitive procurement process on sole source projects, rigorous internal documentation and contracting officers’ approvals are required.

- Lastly, and one of the more interesting vehicles in VA contracting, are Indefinite Delivery/Indefinite Quantity (IDIQ) contracts. This flexible contracting vehicle enables the VA to establish relationships with multiple, qualified contractors without the administrative burden of individually letting individual projects. Rather, with IDIQ contracts, the VA establishes a budget ceiling (ex: $100 million) which functions as a blanket to cover multiple, future projects. This empowers the VA to award up to $100 million of projects (issued via individual task orders) to the predetermined, limited pool of qualified contractors under a master service agreement. Individual task orders might be awarded under best-price or best-value contracting methods. Success in IDIQ contracts often hinges on a contractor’s performance on an initial “seed project”— a real project or even a hypothetical project (called a notional task order) that serves as a gateway to future opportunities on that IDIQ.

- *Bonding Considerations: IDIQ contracts often bid in two phases. The first phase (prequalification phase) might require the submission of a surety prequalification letter. The second phase (RFP phase) usually requires the contractor’s provision of a VA-standard 20% bid bond (capped at $3 million). If the contractor is awarded a seat on the IDIQ contract, subsequent task orders, which are separate and distinct contracts falling under the one master agreement, are underwritten and bonded (separately and distinctly) by the surety company. Keep in mind – because contractor seats on an IDIQ contract are limited, the VA generally expects robust bid participation from each contractor as the task orders are issued. This can evolve into a challenging scenario for the contractor if the contractor is already pushing the limits of their existing bond capacity.

Set-Aside Contracting

Any construction firm is permitted to contract with the VA. However, many of the VA construction contracts are “set-aside” for certified, specialty firms. These specialty firms include:

- Service Disabled Veteran Owned Small Businesses (SDVOSB)

- Veteran Owned Small Businesses (VOSB)

While the VA gives priority to veteran-owned businesses, the agency also advances the interests of Small Business Administration (SBA) programs, including:

- Small Disadvantaged Businesses (SDB)/8(a)

- Woman-Owned Small Businesses (WOSB)

- Historically Underutilized Business Zone (HUBZone) Businesses

The VA’s goal each year is to award approximately 5% of their budget to set-aside construction firms. Nothing stops a certified set-aside contractor from competing on non-set-aside work, however. In fact, the VA’s commitment to supporting veteran-owned businesses adds another layer of complexity to the contracting landscape. A key takeaway from the landmark 2016 Supreme Court Kingdomware decision, the VA’s “Mandatory Rule of Two” gives award priority to SDVOSBs and VOSBs on non-set aside work, when market research suggests they can deliver fair value. This creates both opportunities and challenges for contractors, depending on their ownership structure and business size.

When a contracting officer’s market research does not support limiting the project opportunity to set-aside contractors, the VA gives priority in the award of the project as follows:

- First, certified SDVOSB firms, then

- VOSB firms, then

- Any firm that proposes to use SDVOSBs/VOSBs as subcontractors

While the overall goal is 5%, the VA also carries a specific mandate that SDVOSBs “SHALL” be used—meaning that all contracting opportunities are vetted first to see if SDVOSB contracting can fulfill the need. Based on this, you see many large companies setting up mentor-protegee relationships with SDVOSBs, then creating joint ventures (JV) and bidding on work with them.

Partnering with Set-Aside Contractors

It is not only possible, but common, for non-SDVOSB and non-VOSB firms to pursue set-aside work. In these cases, strategic planning is crucial. A formal mentor-protégé arrangement through the SBA offers one way forward, allowing larger firms to partner with (SD)VOSBs in mutually beneficial relationships. Such arrangements are carefully vetted and approved by the VA, after which a mentor-protégé team can qualify for a 100% (SD)VOSB set-aside project as long as the protégé individually qualifies for that set-aside contract. One benefit of mentor-protégé arrangements is that it is not required that a JV entity (separate legal entity) be created. Other considerations include:

- A mentor-protégé agreement may last up to six years from date of SBA approval.

- A mentor can have only three proteges at one time.

- A protégé can have only two mentors at one time.

- A protégé can have only two mentors total over the life of the business (so choose your mentor carefully)

- Protégés “outgrow” their small business designation and therefore their small business status once their average revenue (trailing 5 year) exceeds $45 million.

*Bonding Considerations: Surety companies provide substantial, ongoing bond support to countless VA mentor-protégé partnerships, once fully vetted. As part of their underwriting, the surety will likely want to review a copy of the executed mentor-protégé agreement. They might even request documentation from the protégé confirming that the protégé is in fact a (SD)VOSB certified by the SBA and VA. In most cases, the (SD)VOSB does not have their own surety relationship established, meaning the mentor is responsible for bringing their own surety capacity to the table and bonding the value of the entire set-aside contract under the mentor’s surety program. Lastly, sureties will also dig into what degree of their client’s (the mentor) success is derived from set-aside contracts. The reason is that if the mentor loses access to those contracts (for example, their protégé outgrows the $45M revenue SBA limit, or the mentor-protégé relationship is irreparably damaged and terminated), then that lost business could significantly impact the mentor’s profitability/creditworthiness.

Other Considerations

- For a host of reasons, it is not uncommon for the VA to postpone/reschedule bid dates for projects, even multiple times.

- The VA requires successful bidders to provide performance and payment bonds within 10 days of contract award. In some cases, bid delays might lead to the “stacking” of outstanding bid bonds for the contractor, which over time could put a strain on the contractor’s available bond capacity. Reason being, bonding companies generally view outstanding bid bonds as potential future bond liability (should the contractor be awarded the contract, and performance and payment bonds be required). The higher the contractor’s amount of outstanding bid bonds at any given time, the more uncertainty there is around how much new work may ultimately be added to the contractor’s existing backlog. This could be problematic if the contractor is already approaching the limits of their existing bonding capacity. As mentioned previously, stacking issues can be further exacerbated if the contractor pursues large negotiated/best-value contracts, on which the correspond bid bonds can be slow to runoff. Working with a surety advisor who is well-versed in VA contracting dynamics is crucial, as is partnering with a surety company that can provide operational flexibility when these situations (inevitably) arise.

- Uncertainty around bid dates/project notice to proceed can lead to challenges in managing schedules for your field personnel, labor pool, and subcontracting relationships. It is important for contractors interested in working with the VA to be aware of this dynamic.

- The VA’s construction projects and needs are managed mainly through Network Contracting Offices (NCOs) – about 20 total – across the U.S. Contracting officers in each of these 20 offices are the VA’s front-line representatives—responsible for managing hundreds of new and existing VA projects across the entire construction ecosystem, with billions of dollars of taxpayer funding at play. Major construction projects (individual projects > $20 million) are managed centrally by the Office of Construction & Facilities Management (CFM) in Washington, D.C. and supported locally by the VA’s various NCOs.

- Successfully securing and executing contracts with the VA requires contractors to establish and maintain strong relationships with the VA’s contracting officers. With many contracting officers contributing to the VA’s success, construction firms should understand the time, energy, and resource commitments involved with managing the many relationships across the VA network.

In Summary

Success in VA contracting requires more than just competitive pricing or technical expertise. It demands a thorough understanding of the agency’s various contracting methods, a strategic approach to partnership opportunities, and the ability to navigate complex regulatory requirements. Firms that invest in developing these capabilities in partnership with a strong surety advisor and bonding company partner often find themselves well positioned for sustainable growth in the federal construction market.

As we look to the future, the VA’s contracting landscape will undoubtedly continue to evolve. New procurement methods may emerge, and existing programs will adapt to changing market conditions. However, the fundamental principles of transparency, fairness, and value will remain constant. For construction firms willing to invest the time and resources necessary to understand and adapt to these requirements, the VA offers a pathway to stable, meaningful work that directly impacts the lives of our nation’s veterans.

The journey to successful VA partnerships may seem daunting, but it’s one well worth considering. By understanding the available contracting methods, embracing partnership opportunities, and maintaining a commitment to excellence, construction firms can build lasting relationships with one of the nation’s largest and most important construction clients.

For more information

We’re ready to help when you are. Get in touch and one of our experienced Baldwin advisors will reach out to have a conversation about your business or individual needs and goals, then make a plan to map your path to the possible.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.