Successfully fulfilling surety bond requirements

Though employee stock ownership plans (ESOPs) have existed since the 1950’s, in recent years, there has been a growing interest in this business model. According to the National Center for Employee Ownership (NCEO), as of 2024, there are roughly 6,500 ESOPs, covering 14.7 million participants and holding over $2.1 trillion in assets. The NCEO also estimates that there is an average of 259 new ESOPs per year, and that over 50 percent of ESOP companies are in the manufacturing, professional services, and construction industries.

An ESOP is a type of retirement plan that gives employees an ownership stake in the company they work for, which incentivizes and rewards employees for their contributions to the company’s success. ESOPs are often used to facilitate succession planning by allowing a company owner to sell their shares and transition out of the business.

Ownership transition through an ESOP transaction can be an effective way of perpetuating your company. If you’re considering an ESOP transition for your company, know that it may or may not be the right fit based on a confluence of factors unique to your business. Additionally, for businesses that use surety bonds, these plans may also impact your ability to obtain surety credit. Before setting up an ESOP, understanding the benefits, potential downsides, and how these plans impact the surety underwriting process can put you in an optimal position to maintain a surety program aligned with your business needs.

How does an ESOP work?

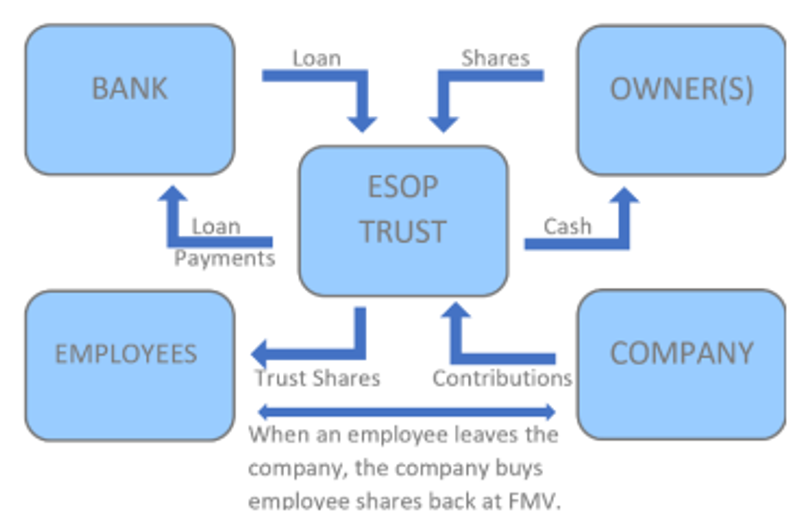

To create an ESOP, a company must form a trust. To fund the trust, the company can contribute cash to buy shares of stock from existing owners at a cost no greater than the fair market value. When companies don’t have the cash to do this upfront, the ESOP can take out a loan to buy new or existing shares while the company contributes money for the trust to pay its loan.

Typically, companies provide employees ownership with no upfront costs for them. A company allocates a percentage of company stock to eligible employees, distributing shares based on several factors, such as years of service and pay scale. The shares allocated to employees in an ESOP must vest before employees are entitled to receive them. Companies often tie distributions from the plan to vesting, with employees generally earning an increasing proportion of shares for each year of their service. Vesting can happen immediately, after a certain number of years, or gradually over time.

The shares are held in the trust until the vested employee retires or leaves the company, at which point the company must buy the shares back for distribution to other employees.

Image source: American University

Advantages and disadvantages

Since ESOPs have grown in popularity, especially in recent years, companies considering this option should understand potential benefits and disadvantages to make informed decisions aligned with business needs and priorities.

An ESOP may be beneficial for companies and their employees in many ways, including:

- Succession planning – ESOPs provide transitional flexibility that lend greater stability with succession planning. Business owners who are ready to sell the business and want more control over the process and outcome may be able to sell their shares to the ESOP, rather than having to find a buyer.

- Employee retention and motivation – Because employees have a direct stake of ownership in the company they help run, ESOPs can improve employee retention and motivation. Research from Rutgers University found that turnover is substantially lower in companies that combine ownership with a supportive and empowering culture. When these strategies are implemented together, annual voluntary employee turnover decreases from about 13% per year to about 2% per year. These improved outcomes translate into improvement of the company’s bottom line.

- Unique employee benefit – Since companies fully fund ESOPs, employees generally don’t have to contribute to an ESOP, which is unlike many other types of retirement accounts.

- Financial benefits – A company can use the sale of shares to raise money for business expenses, and its contributions to an ESOP may be tax-deductible.

However, there may be some hurdles with transitioning to an ESOP, such as:

- Retirement savings risks – For employees, becoming partial owners of the company they work for can be financially and personally rewarding. However, if an ESOP is their sole retirement account, having all income and retirement savings tied to a single company may carry some risk.

- Compliance obligations and overhead – Both the IRS and Department of Labor share jurisdiction over some ESOP features. Companies also have to ensure compliance with ERISA, wage laws, adherence to union agreements (where applicable), and state-specific licensing requirements. ESOPs also require ongoing administration and management by an independent trustee, who is responsible for making fiduciary decisions. Failure to meet fiduciary obligations may lead to liability claims.

- Disruptions in ownership – For ESOPs to be successful, owners need to have a strong transition plan that identifies and trains up new company leaders. This helps minimize the disruption the ownership transition can create among employees and customers.

- Critical financial considerations – When vested employees leave the company or retire, companies need to ensure they have enough funds to cover the payout, taking into account potential appreciation over time. Additionally, if a company borrows money to finance the ESOP, it can create a high debt ratio and negative equity on paper. Taking out a loan to fund an ESOP may also affect alignment with surety bond requirements. Lenders, sureties, or those unfamiliar with ESOPs may shy away from working with you due to these factors.

Assessing company fit

Determining if an ESOP is the right choice for your company requires careful consideration, since certain factors and characteristics impact ESOP viability and your business’s ability to capitalize on the benefits. Some areas to assess include:

- Financial stability – Companies with a history of steady profitability and a lower debt to equity ratio are well suited for an ESOP.

- Employee readiness – Think about employee buy-in and whether or not this model will bolster morale and motivation.

- Company size – Generally, ESOPs are best suited for companies with at least 20 employees.

- Managerial bandwidth – Having an experienced management team at the helm of your business, or preparing the next generation of company leaders is crucial to set up and maintain a successful ESOP

- Maintenance and overhead – Setting up an ESOP, conducting ongoing valuation, understanding regulatory obligations, and ensuring compliance all require monetary investments and proper oversight. You’ll have to assess if your company can cover the costs of initial setup and maintenance.

Surety bond considerations

ESOPs prompt critical changes in key components of a company’s operations and structure in ways that impact the surety bonding process. If you use surety bonds in the course of business, you’ll need to consider how an ESOP can impact surety bond credit. As we detail below, surety companies will review certain elements in order to provide bonding programs to ESOP companies. Fortunately, there are strategies you can leverage to proactively address potential underwriting concerns.

Buyout structure The surety will be actively interested in the structure of the ESOP buyout and will analyze several aspects of the transaction, including the valuation of the business and the debt structure. Underwriters scrutinize these areas to determine if the company’s predicted future cash flow will be sufficient to cover the acquired debt. The surety will also consider the flexibility the contractor has with the financing structure if their performance falls short of projections.

Strategy

The surety should ideally be involved from the early stages of the ESOP transaction, even before it closes, to provide their input. The best outcomes occur when the seller engages the surety in pre-transaction discussions well before assembling their term sheet in coordination with their various advisors, such as legal, accounting and surety broker.

Leadership

Whenever there is an ownership transition, the surety company will want to know which people in key leadership positions will remain through this time period. Because these individuals have a proven track record of performance and have played a pivotal role in the company’s success, if a leadership change is imminent, underwriters will want to know if the leaders will stay for longer, or if they plan to exit. Should there be a change in leadership on the horizon, underwriters will want to understand new leaders’ credentials and their ability to effectively steer the company toward continued success.

Strategy

Conversations with underwriters regarding individuals’ qualifications require nuance and a strategic approach, since it can be difficult to fully quantify the full scope of someone’s leadership abilities. The Baldwin Group’s dedicated surety bond insurance broker have proven experience bridging the gap with underwriters through proactive communication and relationship building strategies that enable the surety to feel confident in the viability of the surety transaction. For example, we bring in the next generation of leaders into meetings with the surety, which helps build a meaningful relationship that enables the underwriter to gain a deeper understanding of who’s going to lead the company after the ESOP transaction is finalized.

Profitability, liquidity, and cash flow

When a company transitions to an ESOP, it will have additional expenses on a monthly and yearly basis associated with set up, maintenance, and financing. If a company is carrying debt to fund the ESOP, it will have to pay back both the principal and the interest, which may significantly impact liquidity and cash flow. The party financing the debt – whether it’s a bank, the company’s seller, or combination of both – also factor into the conversation with the surety, as well as the debt maturation timeline.

Additionally, underwriters will want details regarding the company’s valuation and predictability in income. Companies with significant variability in profits from year to year will have a harder time convincing their surety that the ESOP will be successful, since recessions and downturns can make keeping up with ESOP related payments and expenses challenging.

Strategy

The more consistent your profitability is, the more confidence the surety has in your company’s cash flow and its ability to repay the debt taken on to finance the ESOP purchase. A detailed pro forma showing the financial impact of the ESOP and the path forward is critical. With unpredictability in earnings, ESOP might not be the right option for a company. If you are considering an ESOP, assess if it’s an appropriate fit based on the totality of your distinct business characteristics, since the decision also impacts your ability to obtain surety bonds.

Structuring a surety aligned ESOP

Though there may be some barriers to bonding ESOPs, with the right approach and a trusted, experienced surety advisor on your team, you can successfully navigate this process. You will want to partner with an advisor who has prior experience working with ESOPs at all stages of the transition, and who can leverage this experience along with their market reach and relationships with surety companies to help you achieve optimal outcomes.

As leading surety experts, this is how our team partners with clients to create a surety aligned ESOP.

Facilitating communication

Communicating early and often helps all involved parties identify potential friction points with the surety, enabling companies to course correct if necessary with the ESOP’s structure if underwriting concerns arise. Ideally, the conversation with surety underwriters should start at day zero of the deal’s lifecycle. By opening channels of communication between our clients and surety partners, we garner insights that help companies structure a deal that’s mutually beneficial to the seller and the surety company and enhance long-term success.

Assessing and presenting viable options

There are many options to consider with the purchase structure, and some may be better aligned to balance both the company’s and surety’s needs. ESOP transaction valuations reflect fair market price. This is always greater than the book value of the company, leading to negative equity of the company, and as such, raises concerns for a creditor like a surety. In these scenarios, most sureties prefer the seller finance the debt, and not an outside lender. Depending on the needs and goals of the seller, most deals use a combination of seller and bank debt to finance the purchase. In most cases, the seller financed debt is subordinated to the surety bond company, meaning the surety has some say in the repayment of the seller’s notes. This can take the form of a complete or structured subordination to allow for scheduled principal and interest payments, which helps underwriters view the subordinated debt as capital in the company.

Other mechanisms can be used to offset the impacts to the company’s balance sheet. Sellers may provide the surety a personal guarantee to backstop a deal while the debt is being paid down. We have also seen scenarios where a bank letter of credit or other forms of collateral are posted to bolster the surety’s position while the company is rebuilding its balance sheet. These are all factors that we help our clients weigh when structuring a deal.

Negotiating surety requirements

Our role as a surety advisor is to negotiate on your behalf and bridge the gap between a company and underwriters. What minimum financial requirements would the surety be comfortable with? How can you demonstrate that there is a clear transition plan in place? Will the transition occur in phases? We identify key elements of the deal. With upfront, proactive communication and a strategic approach, we help involved parties reach a consensus and move forward with the necessary surety bonding facility to support the business.

ESOP and surety bonding, in action

As experienced surety brokers, these are some of the ways we’ve worked with clients navigating an ESOP transition and surety bonding requirements.

Trade contractor ownership transition

After thoughtful consideration and analysis, one of our large trade contractor clients decided that an ESOP transaction was the best way forward to transition ownership and maintain the culture of the company. Through multiple meetings, The Baldwin Group’s surety team concluded that the best path forward was to introduce a new surety to the highly experienced management team that had driven strong results for years. The process included identifying a new president.

A trend analysis of company profitability and cash flow was conducted, which showed the company’s ability to easily cover the costs associated with the ESOP transaction. To provide the surety greater comfort, minimum financial benchmark targets were established, which were agreeable to both the company and the surety. The valuation process placed a purchase price at approximately 3.5 times book value, and the seller was agreeable to taking a majority of sales proceeds in a seller’s note.

Based on our ability to establish the credibility of the management team, a fair valuation, and the historically strong earnings power of the company, we arranged surety support at a level greater than that which existed prior to the transaction, with corporate indemnity and seller’s note subordinated, while allowing for principal and interest payments.

General contractor ESOP transition

A large GC client decided that becoming an ESOP owned company was the right fit for their business. The company had been consistently profitable, making them an ideal candidate. Leadership of the company planned to remain in place for the foreseeable future, resulting in minimal operational changes.

Our team engaged the current surety, discussed client goals, and projected impact on the company’s financial position. After discussing multiple potential structures, financing of the transaction would come in the form of seller and bank debt, with roughly 70 percent attributable to bank debt. This structure warranted clear and timely communication of terms to ensure the surety’s comfort.

We had indicative terms from the surety, which included subordination of seller notes and limited personal guarantees from selling owners, to help supplement the impact to the balance sheet from the transaction. Upon closing, the surety facility remained in place to support the ESOP company’s surety needs with no interruption in service.

Specialty subcontractor and continuity planning

A large specialty subcontractor was looking to transition to an ESOP for continuity purposes. The subcontractor was highly respected, and had a history of consistent profitability and best-in-class operations. Though its ownership group was aging out of the business, senior management would continue with the new ESOP structure and employment contracts through the debt term.

Through upfront communication and multiple meetings, we were able to overcome the surety’s initial concerns. Our team enabled the surety to become comfortable with the purchase price and financing structure of roughly 80 percent seller notes and 20 percent bank financing. The sellers agreed to a limited personal guarantee and subordination of the debt.

General contractor surety support, post ESOP transition

A large, highly specialized GC that recently completed a 100 percent leveraged ESOP transaction engaged The Baldwin Groups Surety Center of Excellence to support their post-transaction surety advisory and brokerage success. Though it’s a best practice to bring your surety stakeholder partners in proactively, we were still able to generate a highly favorable outcome even at the stage the GC engaged with us given our technical expertise and market influence.

Our dedicated surety team quickly assessed the overall underwriting scenario and recommended a targeted marketing effort to bring on a new surety partner, which resulted in securing a larger surety facility. The new surety waived personal indemnity of the five legacy owners. This had been a restrictive requirement by their incumbent surety broker and provider, prompting The Baldwin Group’s involvement.

The GC’s significant market share in a high-demand industry vertical/region, track record of high profitability to comfortably service the debt position, along with a highly experienced leadership team that continued to drive best in class performance, enabled our surety experts to deliver an extremely effective surety solution to support the future growth of the company.

Your trusted surety partner

Pursuing an ESOP ownership structure is a multifaceted undertaking that becomes even more complex when you have to meet surety bond requirements. As leading surety advisors, we have proven experience guiding clients through the various aspects of ESOPs and maintaining a bonding program. Connect with The Baldwin Group’s Surety Center of Excellence for customized solutions that safeguard your long-term success.

For more information

We’re ready to help when you are. Get in touch and one of our experienced Baldwin advisors will reach out to have a conversation about your business or individual needs and goals, then make a plan to map your path to the possible.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.