Brought to you by The Baldwin Group in collaboration with Nasdaq

Executive Summary

In response to recent SEC Rules on Cyber Liability disclosures, this year’s 3rd annual survey, conducted in collaboration with Nasdaq, provided critical information regarding D&O and Cyber Liability Insurance. The result is one of the only independent benchmarking reports on spending and purchasing in the D&O & Cyber Marketplace.

Overall, it appears that rates are starting to stabilize for both D&O and Cyber insurance. However, certain industries are still seeing double-digit reductions in D&O rates, while retentions also continue to decline.

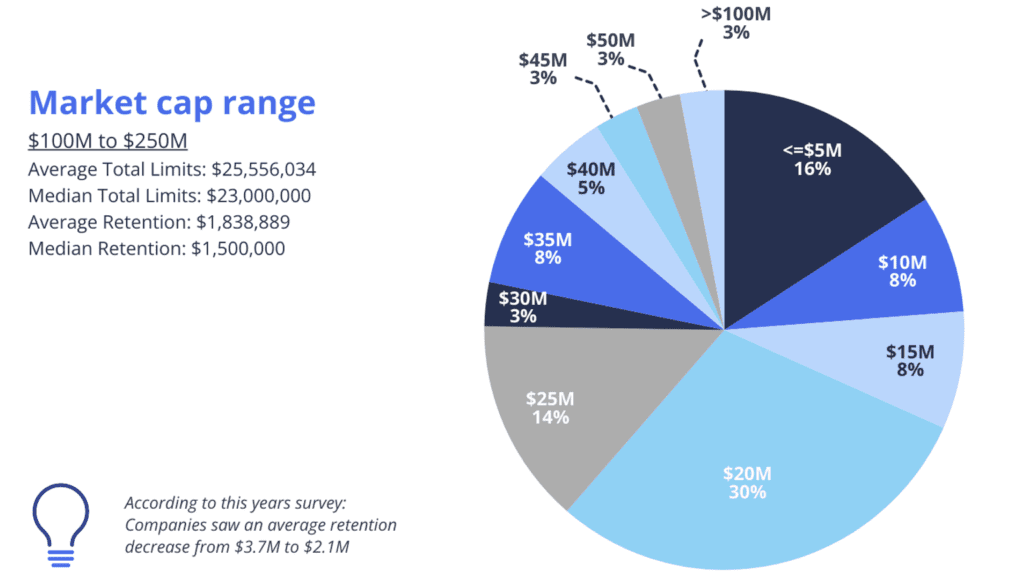

The report will break down total average and median limits purchased, as well as average and median retention amounts, broken out by industry and by market caps ranging from $0 – $50B.

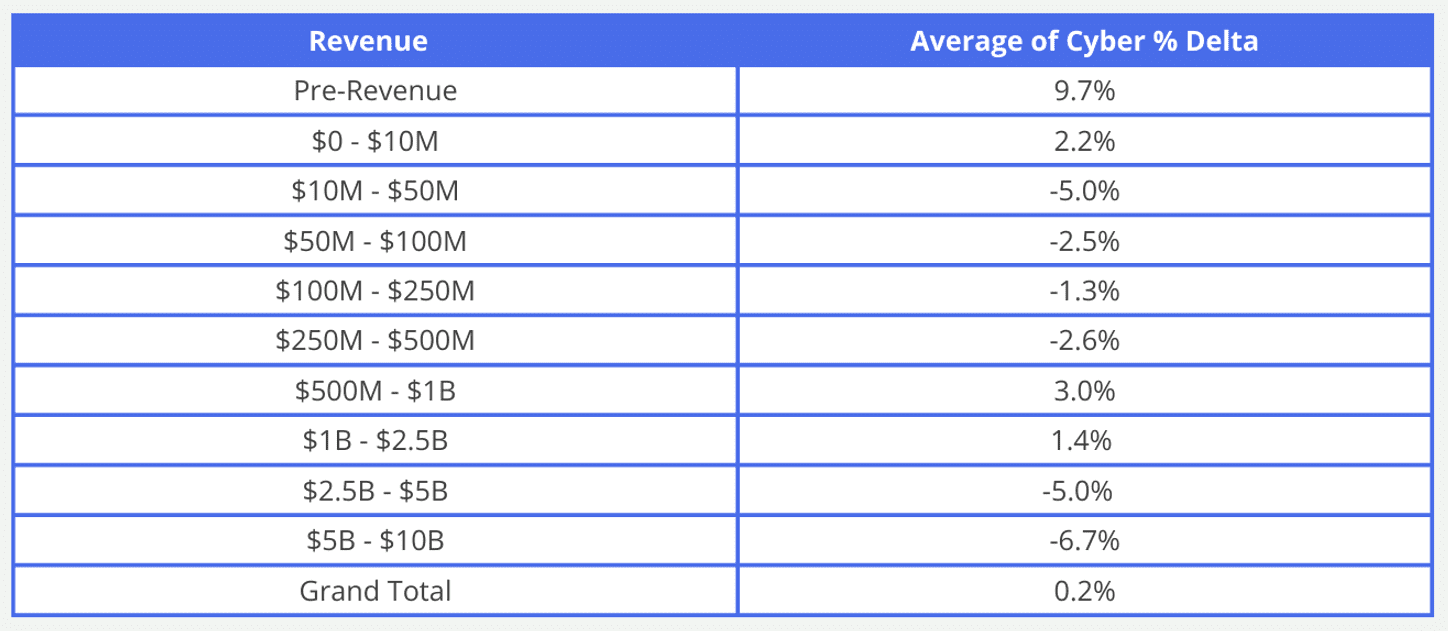

Cyber Rate Changes by Revenue:

Unlike D&O, which saw continued double-digit decreases, the Cyber marketplace has leveled off after several turbulent years of significant increases.

Almost 70% of respondents reported flat renewals in 2023, with no meaningful distinctions between revenue, market cap, or industry.

Observations

- Average rate change across all revenue sectors was 0.2%

- Pre-revenue companies actually saw an almost 10% rate increase in premium, potentially because insurance companies have various metrics (other than revenue) to price those companies which don’t always align with risk or the marketplace.

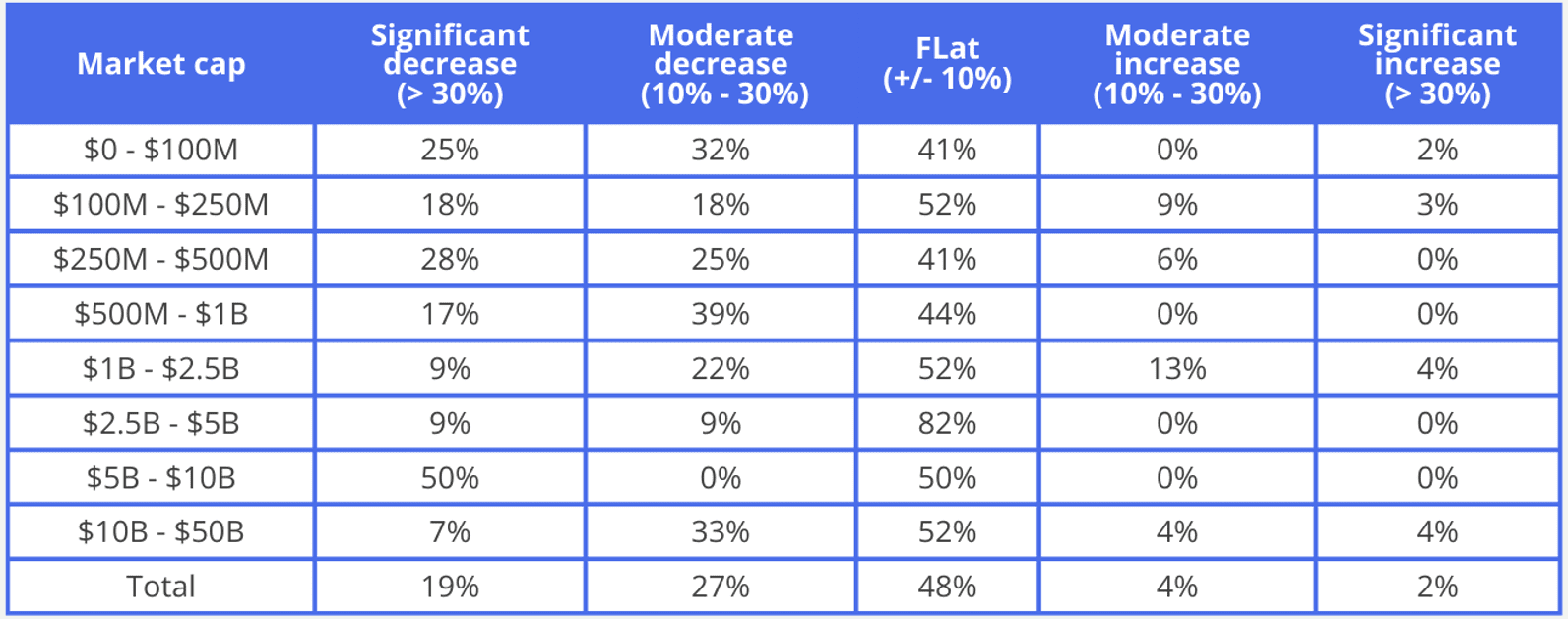

Overall D&O Rate Change data:

Roughly half of all companies saw their overall D&O premiums stay within 10% of last year. Only 19% of companies enjoyed a rate reduction of over 30%. Most of the companies that saw significant rate changes were found between $250M – $1B in market cap, which makes sense as recent IPOs and DeSPACs would fall in that band; which are the companies seeing the greatest decreases.

This year’s report provides a comprehensive overview of D&O and Cyber Liability insurance programs including:

- Changes in rate and retention since last year by market cap, industry and revenues

- Changes in corporate buying habits and policy structure

- Top Primary insurance companies for D&O and cyber liability

- Marketplace views from over 120 D&O underwriters in the U.S. and U.K.

For additional information about the survey or how you can obtain a full copy of the report, please click here or contact us with comments or questions at managementliability@baldwinriskpartners.com.

You may also reach out to your Nasdaq Relationship Manager for more information.

For more information

We’re ready to help when you are. Get in touch and one of our experienced Baldwin advisors will reach out to have a conversation about your business or individual needs and goals, then make a plan to map your path to the possible.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.