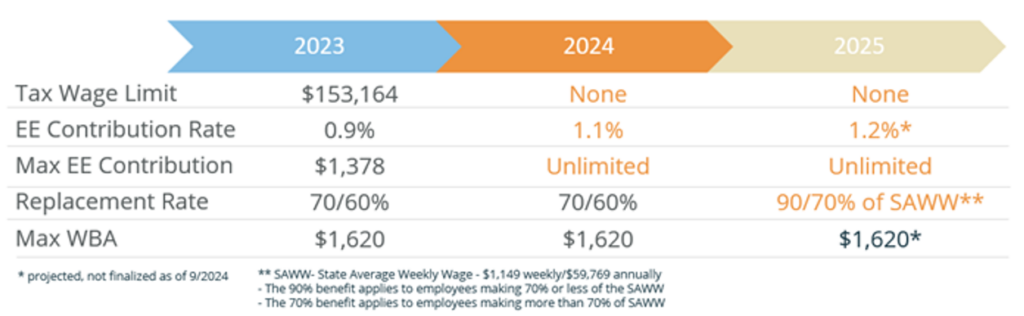

California State Disability Insurance (“CA SDI”) is a program that provides short-term income replacement benefits to eligible workers who are unable to work due to non-work-related illnesses, injuries, or pregnancy. CA SDI benefits are paid out for up to 52 weeks, and the amount of the benefit is based on the worker’s earnings. Significant changes have been made for 2024, and more changes are coming in 2025.

Employer Action Items

- Employers and plan sponsors should evaluate their policies if they offer group short-term and long-term disability plans.

- Employers and plan sponsors should determine if it makes sense to opt out of CA SDI and follow applicable guidelines outlined in this notice.

- Employers and plan sponsors should work with their benefits professional to analyze and make any plan design or overall plan changes.

Summary

The maximum weekly benefit amount (“MWBA”) is not anticipated to change for 2025, meaning that no employee can receive over $1,620 weekly from CA SDI. Therefore, anyone earning over $140,400 will be capped at the MWBA, even though the model is moving to 70% or 90% in 2025. If an employee makes less than $140,400 and more than $60,000, they will be at 70%, and employees earning less than approximately $60,000 annually will be at the 90% benefit. Since the benefit from the state is nontaxable, those earning 90% may be closer to 100% earnings from the state for lower income earners. If the group has a higher average salary or if there are segments of employees in a classification making more, it is becoming more common to carve-out disability plans based on income so that employees are able to replace a larger portion of their pre-disability earnings. Please consult with your benefits professional to perform this analysis.

At any time, an employer does have the option to opt out of CA SDI and create a Voluntary Disability Insurance (“VDI”) program. This is a self-funded disability plan maintained by the employer. There are several rules that are required of these plans:

- VDI plan must be equal in benefits to CA SDI +1 additional enhancement;

- Cannot cost the employee more than CA SDI;

- Must update to match any increases or changes in benefits that CA SDI implements;

- Employers must pay a 14% assessment fee on earnings to the state; often, employers are able to use surplus funds from the VDI plan to pay this or the employer can pay for this fee;

- An employer paid LTD plan (common for CA employers currently) may be required by the VDI carrier; and

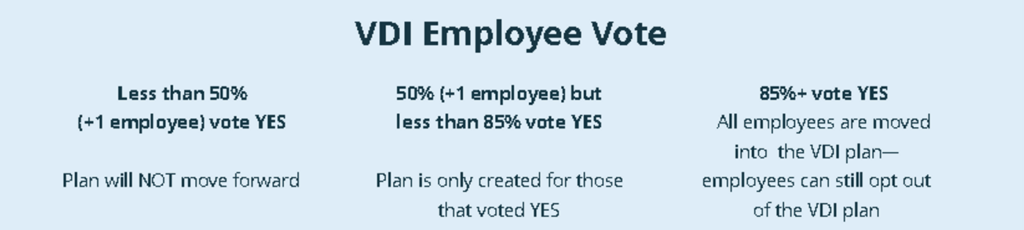

- Opting out of CA SDI and into a VDI plan requires an employee-level vote.

Employers that may want to consider VDI as an option are employers with a health population (low incidence and disability durations), larger employers (500+ employees), higher income employers, companies that have previously considered self-funding disability and employers who want their employees to have enhanced customer service and quicker claims processing timelines.

Additional Resources

- https://edd.ca.gov/siteassets/files/pdf/edddiforecastmay23.pdf

- https://edd.ca.gov/en/disability/Employer_Voluntary_Plans/

For more information

We’re ready when you are. Get in touch and a friendly, knowledgeable Baldwin advisor is prepared to discuss your business or individual needs, ask a few questions to get the full picture, and make a plan to follow up.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.

The Baldwin Group offers insurance services through one or more of its insurance licensed entities. Each of the entities may be known by one or more of the logos displayed; all insurance commerce is only conducted through The Baldwin Group insurance licensed entities. This material is not an offer to sell insurance.