Question

How do employers or plan sponsors determine if they are an applicable large employer (“ALE”) under the Affordable Care Act (“ACA”)?

Answer

The ACA establishes specific requirements for employers classified as “applicable large employers” (“ALEs”). If an employer is categorized as an ALE, it must comply with certain ACA mandates and reporting obligations. An employer, along with its controlled group, is deemed to be an ALE if it has employed, on average, at least 50 full-time employees and full-time equivalent employees during the previous calendar year. It is important to note that ALE status is based on averages from the prior calendar year, not the number on the last day of the year. To determine ALE status, employers should utilize the following guidelines:

- Determine the “average” number of full-time employees for the year. A full-time employee is defined as any employee who averages 30 or more hours per week (or 120 hours of service) during a calendar month;

- Determine the “average” number of full-time equivalent employees (“FTEs”) for the year. An FTE is defined as an employee averaging less than 30 hours per week during a calendar month. To calculate the FTEs for a calendar month, divide the aggregate total hours worked by all FTEs for the month by 120 hours;

- Combine the total number of full-time employees and FTEs for each calendar month, and then divide the total for the full calendar year by 12 to determine if you averaged more than fifty (50) full-time and FTEs for the year.

Keep in mind that although an employer uses 120 hours per month for full-time employees in making an ALE determination, the employer must use 130 hours when determining whether an employee is full-time and should be offered coverage.

Example & Sample Calculation

Company A typically employs between 40 and 45 employees, who usually work over 120 hours per month (or more than 30 hours each week). However, due to recent business demands, they have begun hiring part-time employees to fulfill obligations and meet customer needs. They have also implemented a monthly defensive audit review process to assess their ALE status for the upcoming year.

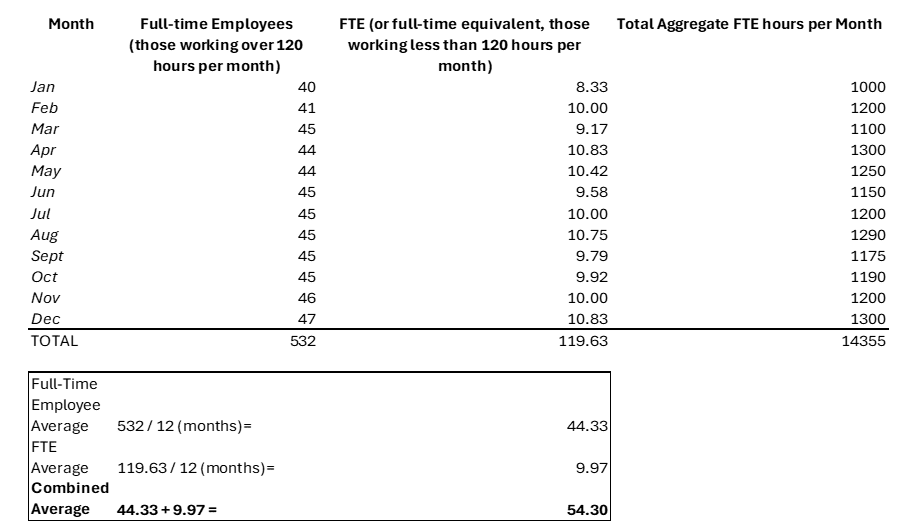

Each month, the Benefits Manager reviews two reports to evaluate and determine the average number of employees in each category: (1) Full-time Employees (those who work over 120 hours per month) and (2) FTEs (employees who work less than 120 hours per month). To calculate the number of full-time employees, they generate a recurring monthly report that counts the total number of employees who worked over 120 hours that month. For FTEs, they aggregate the total hours worked by all part-time employees and divide that total by 120 to find the average FTE count for each month. The chart below illustrates their methods and shows that they averaged 54 employees over the year. As a result, starting next year, they will be subject to certain ACA employer mandates and reporting obligations.

For more information

We’re ready when you are. Get in touch and a friendly, knowledgeable Baldwin advisor is prepared to discuss your business or individual needs, ask a few questions to get the full picture, and make a plan to follow up.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.

The Baldwin Group offers insurance services through one or more of its insurance licensed entities. Each of the entities may be known by one or more of the logos displayed; all insurance commerce is only conducted through The Baldwin Group insurance licensed entities. This material is not an offer to sell insurance.