Part I: Nondiscrimination for Group Term Life Insurance Plans

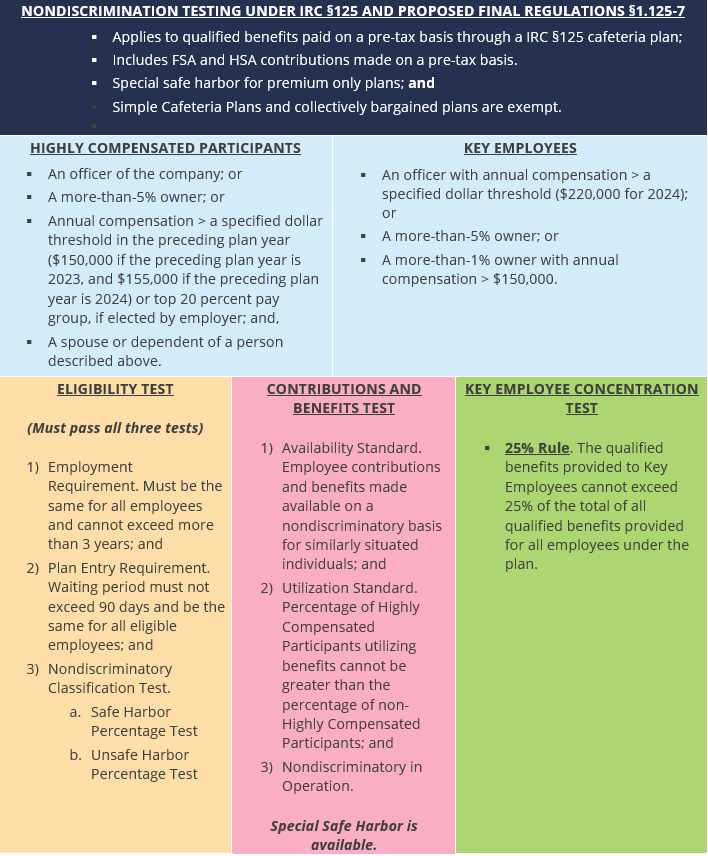

Assessing Section 125 Nondiscrimination Compliance. An IRC §125 plan, commonly referred to as a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences. To receive this tax advantage, the cafeteria plan must generally pass certain tests that are designed to ensure that the plan does not discriminate in favor of Highly Compensated Participants as described below in this section.

Effect of Testing Failures. If a cafeteria plan fails to pass nondiscrimination testing, Highly Compensated Participants lose the tax benefits of participating in the plan (that is, they must include the benefits or compensation in their income), based on “the value of the taxable benefit with the greatest value that the employee could have elected to receive, even if the employee elects to receive only the nontaxable benefits offered”. However, even if a cafeteria plan is discriminatory, non- Highly Compensated Participants will not lose the tax benefits of participating in the plan.

Certain Exceptions and Safe Harbors Excuse Testing Failures. Certain exceptions and safe harbors apply to the cafeteria plan nondiscrimination tests. Because these tests are so complex, employers should work with their benefit advisors or legal counsel when performing cafeteria plan nondiscrimination testing.

Applicable Nondiscrimination Tests. In general, a cafeteria plan must satisfy the following three nondiscrimination tests:

- The Eligibility Test;

- The Benefits and Contributions Test; and

- The Key Employee Concentration Test.

Part II: Eligibility Test

Eligibility Testing. The Eligibility Test looks at whether a sufficient number of non-Highly Compensated Participants are eligible to participate in the cafeteria plan. If too many non-Highly Compensated Participants are ineligible to participate, the plan will fail this discrimination test.

Part III: Highly Compensated Participants

Assessing Highly Compensated Participant Status.

A Highly Compensated Participant includes any individual who is:

- An officer; or

- A shareholder owning more than 5 percent of the voting power or value of all classes of stock of the employer; or

- A highly compensated employee (HCE); AND

- A spouse or dependent of a person described above

An employee is generally considered to be an HCE if the individual had compensation in excess of a specified dollar threshold for the preceding plan year ($150,000 if the preceding plan year is 2023, and $155,000 if the preceding plan year is 2024), and, if elected by the employer, was also in the “top-paid group” of employees (that is, the top 20 percent).

Part IV: Testing Group

Participants of Testing Group. All employees (including leased employees) who were employed on any day during the plan year must be included in the testing group. Non-Key Employees covered by a collective bargaining agreement, non-resident aliens with no U.S. source income, and COBRA employees participating the cafeteria plan may be excluded.

Part V: Testing Requirements

Eligibility Test Requirements. Under the Eligibility Test, a plan does not discriminate in favor of Highly Compensated Participants if it meets the following requirements:

| Employment Requirement | The same employment requirement applies to all employees and the plan does not require more than three years of employment to participate. |

| Entry Requirement | Entry into the plan is not delayed. |

| Nondiscriminatory Classification Requirement | The plan benefits a classification of employees that does not discriminate in favor of Highly Compensated Participants. |

Applicable Waiting Periods. The Affordable Care Act (ACA) prohibits group health plans from applying any waiting period that exceeds 90 days. This ACA provision affects cafeteria plans because employers will generally want to allow employees to pay for their health plan coverage on a pre-tax basis, starting when they first become eligible for health plan coverage. Thus, employers will typically align their health plan’s and cafeteria plan’s waiting periods, which means that a cafeteria plan should rarely have a waiting period that exceeds 90 days.

Non-discriminatory Classifications. The nondiscriminatory classification component incorporates certain rules applicable to qualified retirement plans. A plan satisfies this component for a plan year if:

- The plan benefits employees who qualify under a reasonable classification established by the employer; and

- The classification is nondiscriminatory.

Reasonable Classifications. A reasonable classification must be based on objective business criteria. Reasonable classifications generally include specified job categories, nature of compensation (that is, salaried or hourly), geographic location and similar bona fide business criteria.

Safe Harbor versus Unsafe Harbor Percentage Tests. A classification is nondiscriminatory if it satisfies either a “Safe Harbor Percentage Test” or an “Unsafe Harbor Percentage Test” for the plan year. These percentage tests are laid out in IRS regulations and involve dividing the percentage of non-Highly Compensated Participants who benefit under the plan by the percentage of Highly Compensated Participants who benefit under the plan. The result is the plan’s ratio percentage. If the plan’s ratio percentage is 50 percent or more, the plan will satisfy the Safe Harbor Percentage Test. If it is less than 50 percent, the plan may still be nondiscriminatory, depending on the employer’s concentration of non-Highly Compensated Participants and whether the plan can pass either the Safe Harbor Percentage Test or the Unsafe Harbor Percentage Test.

Part VI: Benefits & Contributions Test

Discrimination as to Highly Compensated Participants. A plan may not discriminate in favor of Highly Compensated Participants as to benefits or contributions. This test is designed to make sure that a plan’s contributions and benefits are available on a nondiscriminatory basis and that Highly Compensated Participants do not select more nontaxable benefits than non-Highly Compensated Participants.

Safe Harbor Available. Before an employer runs the Benefits and Contributions Test for its cafeteria plan, it should determine whether it can use the safe harbor rule described below.

Part VII: Highly Compensated Participants

Highly Compensated Participants are those who are enrolled and participating in the underlying plan.

Part VIII: Testing Group

Participants of Testing Group. Employees who are eligible to select benefits under the cafeteria plan, and, if applicable, to make salary reductions to pay for those benefits, are included in the testing group.

Part IX: Testing Requirements

Utilization & Operation. IRS regulations provide that a cafeteria plan must satisfy the Benefits and Contributions Test with respect to both the utilization and the availability of such benefits. Further, the regulations also require the cafeteria plan to be nondiscriminatory with respect to its operation. A plan will pass or fail the Benefits and Contributions Test based upon the facts and circumstances of each case.

Part X: Availability of Benefits

Evaluating Contribution & Benefits. A cafeteria plan satisfies the availability requirement by showing that employer contributions are available on a nondiscriminatory basis or that benefits are available on a nondiscriminatory basis. This test generally requires a cafeteria plan to make available the same qualified benefits at the same price for similarly situated participants.

Part XI: Utilization of Benefits

Participant Elections. The utilization requirement analyzes whether Highly Compensated Participants elect benefits to a greater extent than non-Highly Compensated Participants. For example, a plan would likely fail this test if benefits were so expensive that only Highly Compensated Participants could afford to elect the benefits.

Part XII: Nondiscrimination in Operation

Participant Utilization. IRS regulations require that a cafeteria plan may not discriminate in favor of Highly Compensated Participants respecting plan operations. Among other things, this means a cafeteria plan may be discriminatory in operation if the duration of a benefit offered through the plan is for a period during which only Highly Compensated Participants may or will utilize the benefit.

Part XIII: Safe Harbor Rule

Conditional Safe Harbor for Discrimination Testing Failures. There is a special safe harbor rule under the Benefits and Contributions Test for cafeteria plans that provide health benefits (that is, major medical coverage). If a health plan satisfies the safe harbor, then the plan passes the Benefits and Contributions Test. It must still, however, satisfy the Eligibility Test and the key employee concentration test. The following three requirements must be met to qualify for the safe harbor:

- The cafeteria plan must provide major medical coverage benefits;

- Contributions under the cafeteria plan on behalf of each participant must equal 100 percent of the cost of health benefit coverage under the plan of the majority of the similarly situated Highly Compensated Participants or the contribution on behalf of each participant must equal or exceed 75 percent of the cost of the most expensive health benefit coverage available under the plan for similarly situated participants; and

- If the cafeteria plan provides contributions or benefits in excess of the amounts needed to satisfy the 100 percent or 75 percent standard, the excess contributions must bear a uniform relationship to compensation.

Effect of Differences in Plan Benefits. In determining which participants are similarly situated, reasonable differences in plan benefits may be taken into account (for example, variations in plan benefits offered to employees working in different geographical locations or to employees with family coverage versus employee-only coverage).

Safe Harbor Rule Example:

- All 10 of Employer E’s employees are eligible to elect between permitted taxable benefits and salary reduction of $8,000 per plan year for self-only coverage in the major medical health plan provided by Employer E. All 10 employees elect the $8,000 salary reduction for the major medical plan.

- The cafeteria plan satisfies the safe harbor rule under the Benefits and Contributions Test.

Part XIV: Key Employee Concentration Test

Discrimination as to Key Employees. Under the Key Employee Concentration Test, a cafeteria plan may not provide total benefits (referred to as “qualified” or “statutory nontaxable” benefits) to Key Employees that exceed 25 percent of the total benefits for all employees under the cafeteria plan.

Part XV: Who is a Key Employee?

Assessing Key Employee Status. The definition for Key Employee for purposes of IRC §125 nondiscrimination testing is the same as the IRC §416(i)(1) definition. Under IRC §416, a Key Employee generally is any employee (or former employee, including a deceased employee) who, during the plan year, was:

- An officer of the employer with annual compensation in excess of a specified dollar threshold ($220,000 for 2024); or

- A more-than-5% owner of the employer; or

- A more-than-1% owner of the employer with annual compensation in excess of $150,000 (not indexed).

Family Members. The rules may require, among other things, counting interests held by the owner’s spouse, children, grandchildren, and parents; interests held by certain partnerships in which the owner may be a partner; and a proportionate share of stock owned by corporations in which the owner is a 50% or more shareholder.

Former Employees. A former employee is considered to be a Key Employee if he or she was a Key Employee when he or she retired or otherwise separated from service.

Participants of Testing Group. Plan participants who have elected qualified benefits under the cafeteria plan are included in the testing group.

Part XVI: Consequences of Failing the Key Employee Concentration Test

If a cafeteria plan fails the Key Employee Concentration Test, each Key Employee must include in his or her gross income an amount that equals the maximum taxable benefits that he or she could have elected for the plan year.

Part XVII: Questions & Additional Support

Additional Support

To obtain additional support for performance of these and other nondiscrimination related requirements, as mandated by the Internal Revenue Code, please reach out to your local service colleague or your client advisor. The Baldwin Group maintains an extensive suite of support solutions and advisory guidance capabilities respecting an employer plan sponsor’s performance of its IRS nondiscrimination related compliance assuredness activities. The Baldwin Regulatory Compliance Collaborative (the “BRCC”) also offers a carefully curated range of consultative and advisory support solutions related to the administration of US-based employee benefit plans, program, and other offerings.

For more information

We’re ready when you are. Get in touch and a friendly, knowledgeable Baldwin advisor is prepared to discuss your business or individual needs, ask a few questions to get the full picture, and make a plan to follow up.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.

The Baldwin Group offers insurance services through one or more of its insurance licensed entities. Each of the entities may be known by one or more of the logos displayed; all insurance commerce is only conducted through The Baldwin Group insurance licensed entities. This material is not an offer to sell insurance.