Part I: Nondiscrimination for Group Term Life Insurance Plans

Excludable up to $50,000. Group term life insurance coverage is deductible by employers as a business expense, unless the employer is a beneficiary of the policy. Employees may also generally exclude coverage up to $50,000 from their income. Coverage above that amount must be included in an employee’s income and is subject to Social Security and Medicare taxes.

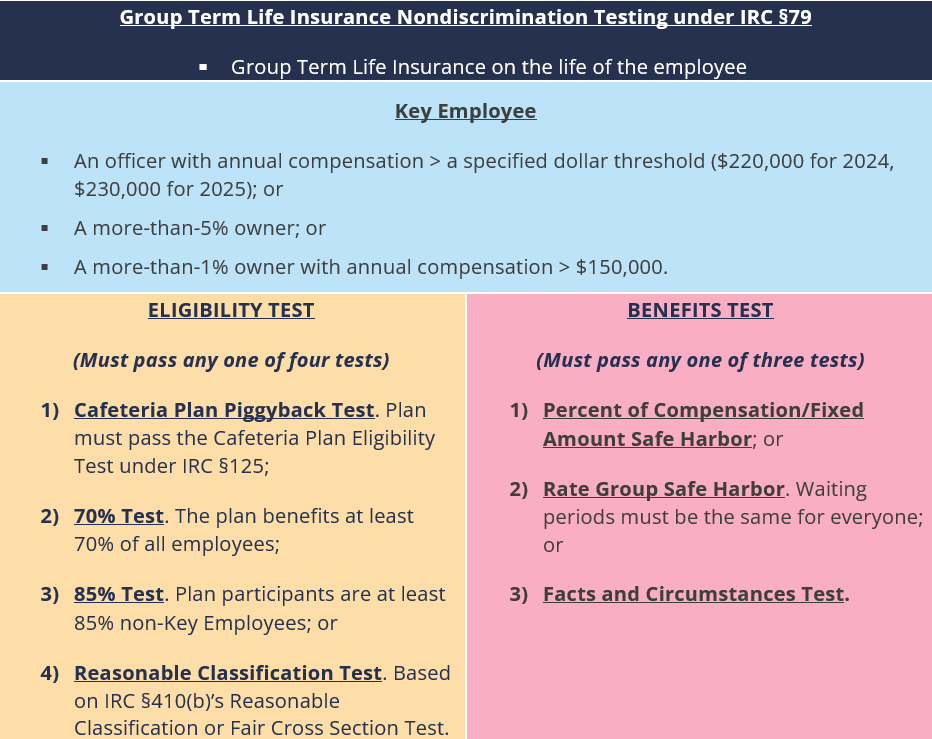

Discrimination in Favor of Key Employees Prohibited. The plan may not discriminate in favor of Key Employees regarding their eligibility to participate or the amount of benefits available to them. If the plan does discriminate in favor of Key Employees, those employees are not able to exclude their first $50,000 in coverage from gross income. There are two group term life insurance nondiscrimination tests: the Eligibility Test and the Benefits Test.

Discrimination in Favor of Key Employees. Employer-provided group term life insurance cannot discriminate in favor of Key Employees as to eligibility to participate. This test is passed by meeting one of four alternative tests—the Cafeteria Plan Piggyback Test; the 70% Test; the 85% Test; or the Reasonable Classification Test.

Part II: Cafeteria Plan Piggyback Test

Effect of Cafeteria Plan. A group-term life insurance plan does not discriminate as to eligibility if it is part of a cafeteria plan that meets the requirements of IRC §125. This provision simplifies nondiscrimination testing for employers that offer group-term life insurance coverage through their cafeteria plans, because only one Eligibility Test (the cafeteria plan Eligibility Test) must be run.

Part III: The 70% Test

Discrimination as to Eligibility. A group-term life insurance plan also does not discriminate as to eligibility if the plan benefits 70% or more of all employees of the employer, including employees of controlled group members and leased employees.

Part IV: The 85% Test

Non-Key Employee Participation. A group-term life insurance plan also does not discriminate as to eligibility if at least 85% of all employees who are participants under the plan are non-Key Employees. There is some data collection involved in this test, and a mathematical comparison between the number of Key Employees and non-Key Employees participating is required, but this is a relatively simple test to run.

Part V: The Reasonable Classification Test

Utilization of Reasonable Classifications. A group-term life insurance plan also does not discriminate as to eligibility if it benefits those employees who “qualify under a classification set up by the employer and found by the IRS not to be discriminatory in favor of Key Employees” (i.e., a reasonable classification). This test is worded like the reasonable classification test for self-insured medical reimbursement plans. However, as with the nondiscrimination rules in IRC §105(h), it is not clear whether to apply the rules currently in effect for qualified plans under IRC §410(b)(2)(A)(i) and Treas. Reg. §1.410(b)-4 or the old fair cross-section test that was used under IRC §410(b) before the Tax Reform Act of 1986. As a result, employers should try to meet either one of these reasonable classification tests. The same rules would apply to group-term life insurance plans, except that the prohibited group consists of Key Employees instead of highly compensated employees.

Part VI: Benefits Test

Discrimination as to Key Employees. Employer-provided group-term life insurance cannot discriminate in favor of Key Employees as to benefits. This test includes two safe harbors, the Percent of Compensation/Fixed Amount Safe Harbor and the Rate Group Safe Harbor. It also applies a facts-and-circumstances standard to benefits that do not satisfy either safe harbor.

Part VII: Who is a Key Employee?

Assessing Key Employee Status. The first step in understanding the nondiscrimination rules for group -term life insurance arrangements is to define the term “Key Employee.” That definition for purposes of group-term life insurance nondiscrimination testing is generally the same as the IRC §416(i)(1) definition. Under IRC §416, a Key Employee generally is any employee (or former employee, including a deceased employee) who, during the plan year, was:

- An officer of the employer with annual compensation in excess of a specified dollar threshold ($220,000 for 2024, $230,000 for 2025); or

- A more-than-5% owner of the employer; or

- A more-than-1% owner of the employer with annual compensation in excess of $150,000 (not indexed).

Family Members. The rules may require, among other things, counting interests held by the owner’s spouse, children, grandchildren, and parents; interests held by certain partnerships in which the owner may be a partner; and a proportionate share of stock owned by corporations in which the owner is a 50% or more shareholder.

Former Employees. A former employee is considered to be a Key Employee if he or she was a Key Employee when he or she retired or otherwise separated from service.

Part X: Questions & Additional Support

Additional Support

To obtain additional support for performance of these and other nondiscrimination related requirements, as mandated by the Internal Revenue Code, please reach out to your local service colleague or your client advisor. The Baldwin Group maintains an extensive suite of support solutions and advisory guidance capabilities respecting an employer plan sponsor’s performance of its IRS nondiscrimination related compliance assuredness activities. The Baldwin Regulatory Compliance Collaborative (the “BRCC”) also offers a carefully curated range of consultative and advisory support solutions related to the administration of US-based employee benefit plans, program, and other offerings.

For more information

We’re ready when you are. Get in touch and a friendly, knowledgeable Baldwin advisor is prepared to discuss your business or individual needs, ask a few questions to get the full picture, and make a plan to follow up.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.

The Baldwin Group offers insurance services through one or more of its insurance licensed entities. Each of the entities may be known by one or more of the logos displayed; all insurance commerce is only conducted through The Baldwin Group insurance licensed entities. This material is not an offer to sell insurance.