Part I: NONDISCRIMINATON FOR SELF-INSURED PLANS

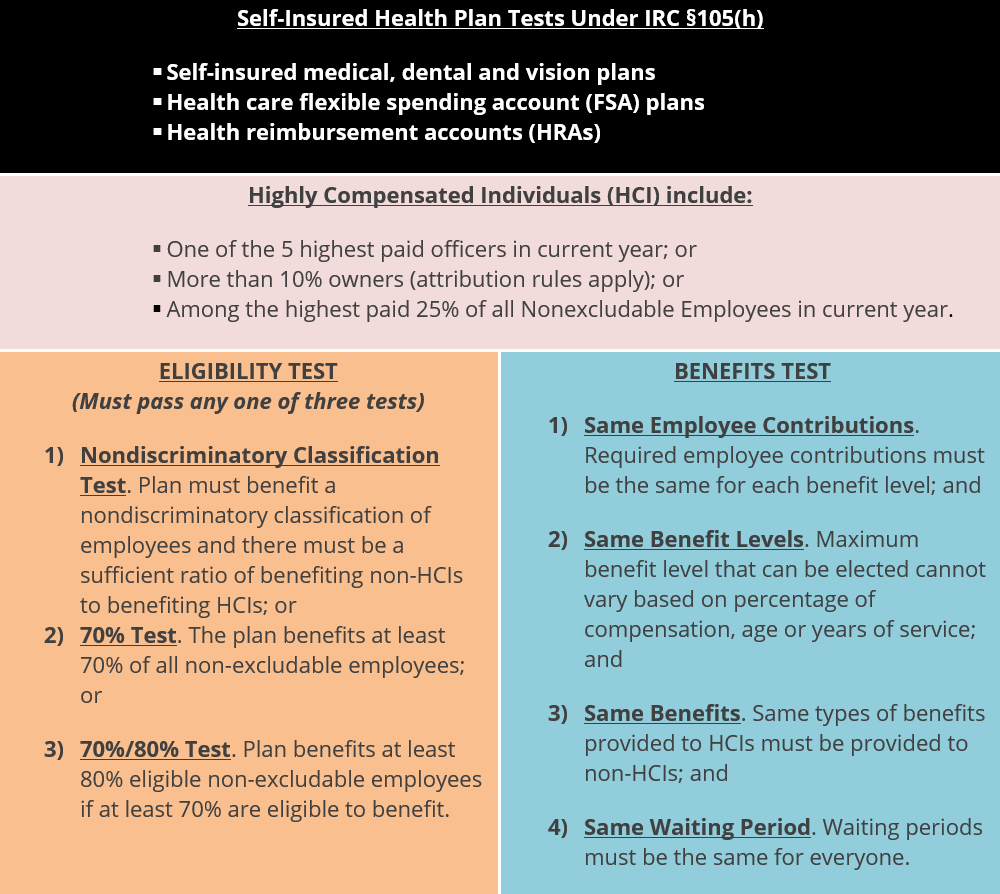

The Internal Revenue Code (“IRC”) §105(h) nondiscrimination rules generally apply to self-insured medical reimbursement plans. All self-insured health plans are subject to these nondiscrimination rules—no exceptions apply for small employers or plans that have grandfathered status under the Affordable Care Act (“ACA”).

Benefits Subject to Nondiscrimination. Self-insured benefits that are subject to the §105(h) nondiscrimination rules include:

- Self-insured medical benefits, including preferred provider organization (“PPO”) plans, health maintenance organization (“HMO”) plans and high deductible health plans (“HDHPs”);

- Self-insured dental and vision benefits;

- Health flexible spending accounts (“FSAs”); and

- Health reimbursement arrangements (“HRAs”).

Hybrid Arrangements. Some group health plans may include both insured and self-insured components. For example, an employer’s health plan may include a fully insured medical benefit and an HRA that reimburses eligible medical expenses up to the fully insured benefit’s deductible. Although the fully insured medical benefit is not subject to the §105(h) nondiscrimination rules, the self-insured portion of the plan—for example, the HRA benefit—is subject to these rules.

Applicable Nondiscrimination Tests. An overview of the of the nondiscrimination tests applied to these types of self-insured employee benefit plans and programs is reflected in the flowchart below:

PART II: IRC SECTION 105(h) TESTING SUMMARY

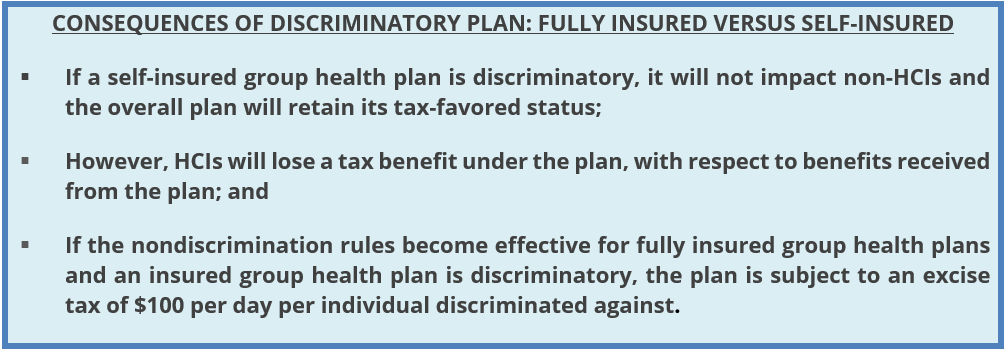

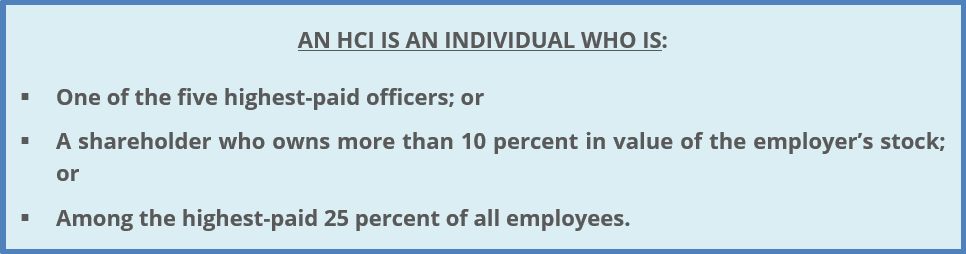

Consequences of Failure. Under IRC §105(h), if an employer’s self-funded health plan provides tax-free health benefits to its employees, the plan cannot discriminate in favor of HCIs with respect to either eligibility or benefits. If a self-insured health plan fails either the Eligibility or Benefits Test, HCIs will be taxed on their “excess reimbursements” from the plan.

Timing & Correction of Failures. A self-insured health plan should be tested for nondiscrimination at least annually. A self-insured health plan cannot correct a failed discrimination test by making corrective distributions after the end of the plan year. Thus, depending on the plan’s design, an employer may wish to monitor its health plan’s compliance with the §105(h) rules throughout the plan year to avoid adverse tax consequences for HCIs.

Service Providers & Exceptions. Because §105(h) testing is complex, employers with self-insured plans should work with their service providers when performing this nondiscrimination testing. There are some permitted ways to structure health plan benefits in a way that highly compensated employees may still receive favored status (for example, a separate fully insured group health plan for HCIs offered outside of a cafeteria plan), but due to the complicated nature of the rules, employers should consult with legal counsel before implementing one of these designs.

PART III: ELIGIBILITY TEST

Testing Failures. The Eligibility Test under IRC §105(h) looks at whether a sufficient number of non-HCIs benefit under a self-insured health plan. If not enough non-HCIs are benefitting, the plan will fail this discrimination test.

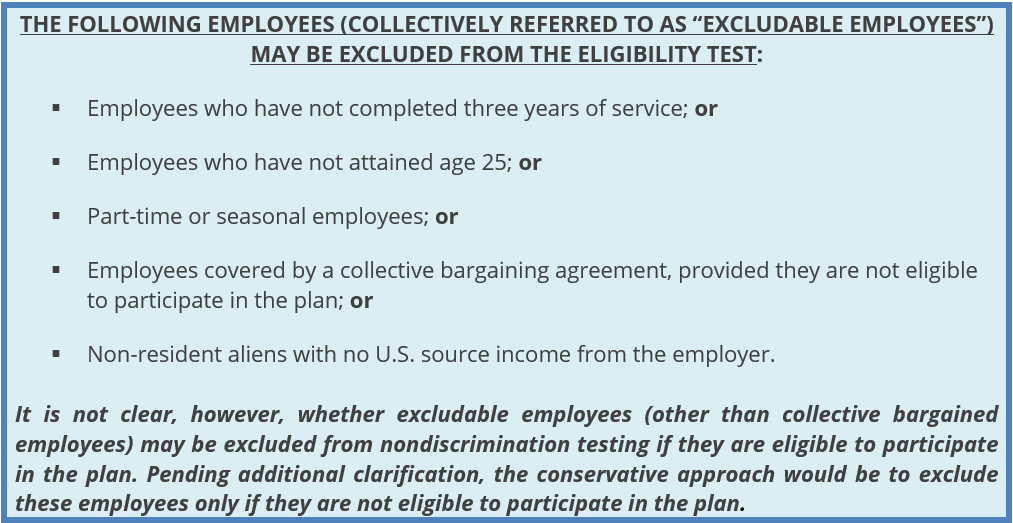

PART IV: TESTING GROUP

Testing Group. With a few exceptions, all employees of the employer must be included in the testing group. For nondiscrimination testing purposes, the IRC treats two or more employers as a single employer if there is sufficient common ownership or a combination of joint ownership and common activity. Thus, if companies are part of the same controlled group or affiliated service group under IRC §§414(b), (c) and (m), all employees of those companies must generally be included in the nondiscrimination testing.

PART V: TESTING REQUIREMENTS

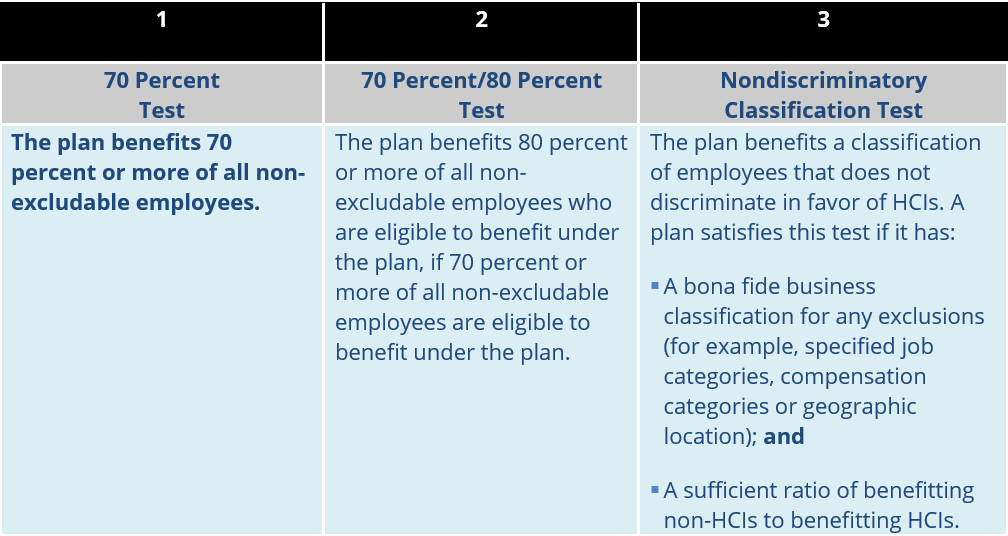

Eligibility Test. IRC §105(h) provides three different ways for a self-insured health plan to pass the Eligibility Test.

Enrolled versus Eligible. Federal tax law does not define what it means to “benefit” under a self-insured plan for purposes of IRC §105(h)’s Eligibility Test. Based on the wording of the test, it seems logical that “benefitting” means that an employee is actually enrolled in the plan and actively participating (rather than being merely eligible for coverage). Other interpretations may also be acceptable, but given the lack of IRS guidance in this area, employers should work with their legal counsel if they want to use another interpretation.

Special Rule for HMOs. Also, if an employer offers an HMO option in addition to its self-insured health plan, there is a special rule that allows HMO participants to be considered for purposes of the Eligibility Test. This special rule may be used if the employer’s contributions to the HMO equal or exceed those to the self-insured health plan.

Part VI: The Benefits Test

Highly Compensated Individual Discrimination. The Benefits Test detailed under IRC §105(h) is designed to prevent health plans from providing HCIs with better benefits, either in terms of how the plan is designed or how it operates.

Part VII: Plan Design

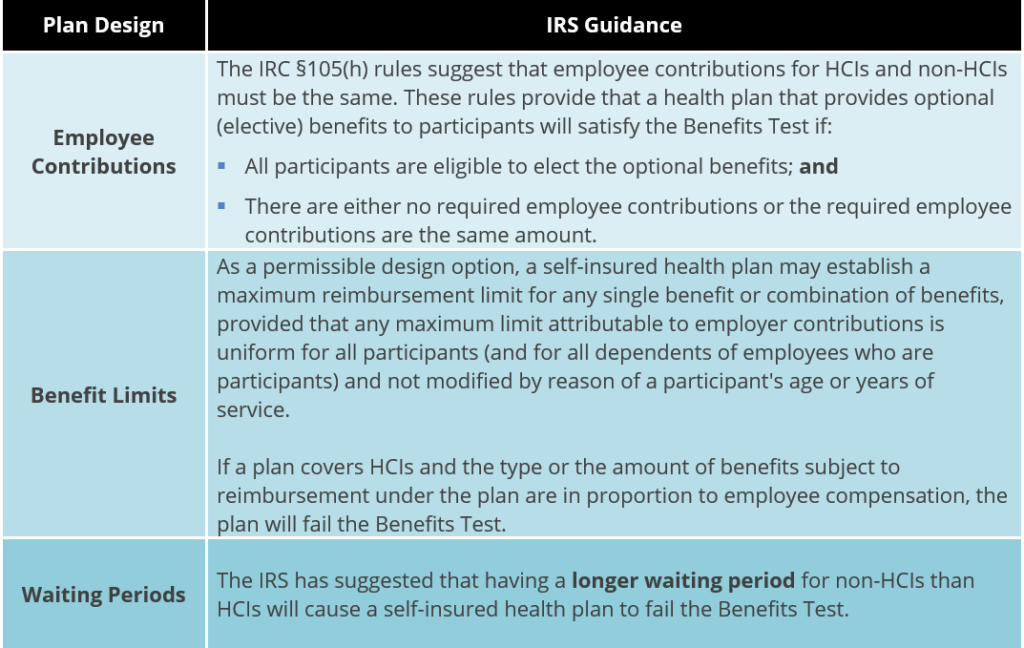

Satisfying the IRC §105(h) Requirements. A health plan does not satisfy IRC §105(h) nondiscrimination testing unless all the benefits provided to participants who are HCIs are provided for all other participants. In addition, all the benefits available for the dependents of HCIs must be available on the same basis for the dependents of all other employees who are participating in the plan.

Actual Claims and Payments Disregarded. This test analyzes the benefits that may be reimbursed under the plan’s terms. It does not take into account actual benefit payments or claims. Also, employers may be able to aggregate or disaggregate benefit plans pursuant to IRS rulemaking, to the extent necessary to pass the Benefits Test.

The IRS has provided the following guidance on specific plan design features:

Executive Physicals. The IRC §105(h) rules include a special exception for medical diagnostic procedures for employees. This exception allows employers to provide free “executive physicals” to certain key employees (often, all HCIs) without violating the nondiscrimination rules. The medical diagnostic procedures include routine medical examinations, blood tests and X-rays.

Part VIII: Plan Operation

Discrimination in Operation. In addition to being nondiscriminatory in its design, a self-insured health plan must not discriminate in favor of HCIs in actual operation. Determining whether a health plan discriminates in operation involves a “facts and circumstances” analysis. A plan is not considered discriminatory merely because HCIs participating in the plan use a broader range of plan benefits than other employees participating in the plan. However, a plan may violate the Benefits Test if the plan’s procedures for approving benefit claims are applied more favorably to HCIs than non-HCIs.

Discrimination Upon Termination. In addition, if a plan (or a particular benefit provided by a plan) is terminated, the termination would cause the plan’s benefits to be discriminatory if the duration of the plan (or benefit) has the effect of discriminating in favor of HCIs. Prohibited discrimination may occur, for example, where the duration of a particular benefit coincides with the period during which an HCI uses the benefit.

Part IX: Consequences of Failed Testing

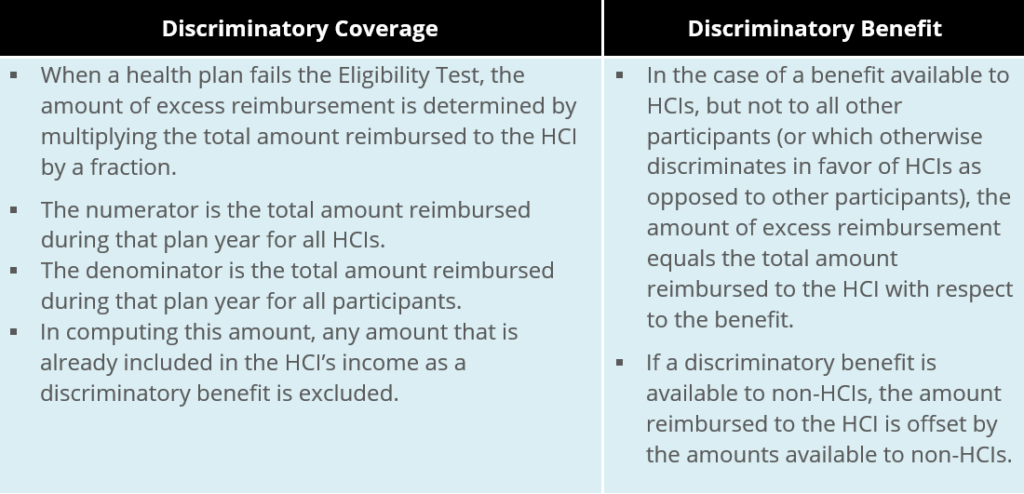

Taxation of HCIs. If a plan discriminates in favor of HCIs, HCIs will be taxed on excess reimbursements that would have otherwise been excluded from their income. The excess reimbursements should be included in the HCIs’ gross income and reported on their Forms W-2. Although excess reimbursements are includible in gross income, these amounts are generally not subject to income tax or employment tax (FICA or FUTA) withholding.

After-tax Premium Payments. The method for determining the amount of excess reimbursements depends on whether the health plan failed IRC §105(h) testing due to discriminatory coverage or discriminatory benefits. Also, if an HCI pays for coverage on an after-tax basis (or has his or her cafeteria plan contributions taxed due to a failed IRC §125 nondiscrimination test), the HCI will only be taxed on the proportion of the discriminatory coverage or benefit that is attributable to employer contributions.

Part X: Questions & Additional Support

Additional Support

To obtain additional support for performance of these and other nondiscrimination related requirements, as mandated by the Internal Revenue Code, please reach out to your local service colleague or your client advisor. The Baldwin Group maintains an extensive suite of support solutions and advisory guidance capabilities respecting an employer plan sponsor’s performance of its IRS nondiscrimination related compliance assuredness activities. The Baldwin Regulatory Compliance Collaborative (the “BRCC”) BRCC also offers a carefully curated range of consultative and advisory support solutions related to the administration of US-based employee benefit plans, program, and other offerings.

For more information

We’re ready when you are. Get in touch and a friendly, knowledgeable Baldwin advisor is prepared to discuss your business or individual needs, ask a few questions to get the full picture, and make a plan to follow up.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.

The Baldwin Group offers insurance services through one or more of its insurance licensed entities. Each of the entities may be known by one or more of the logos displayed; all insurance commerce is only conducted through The Baldwin Group insurance licensed entities. This material is not an offer to sell insurance.