March 5, 2025

Stephanie Hall, Associate Director, Benefits Compliance

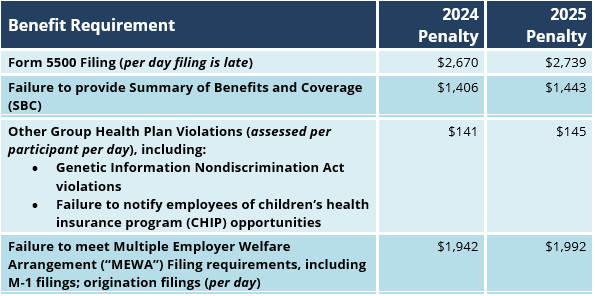

The Department of Labor (“DOL”) has announced the 2025 annual adjustments to the civil monetary penalties assessed or enforced by the DOL, including those related to a wide range of employee benefit compliance failures.

The 2025 adjustments became effective for penalties assessed after January 15, 2025. The items of most significance with respect to health and welfare benefit compliance matters are reflected in the following chart.

Employer Action Items

- Submission of Form 5500: Form 5500 and Form 5500-SF must be filed electronically with the Employee Benefits Security Administration (EBSA), which is a division of the U.S. Department of Labor (DOL). These forms are used to report information to the EBSA about employee benefit plans maintained by employers. Standard, timely Form 5500 submissions are due on the last day of the seventh month after the plan year ends. For calendar year plans, this date is typically July 31st. Employers can request an extension, giving them until October 15th to submit the form and supporting documents.

- Requesting a Form 5500 Filing Extension: Form 5558 is used specifically to extend the filing deadlines for certain employee benefit plan-related forms, including Form 5500, for an additional 2 ½ months. This simple, one-page form is automatically approved and must be filed via U.S. mail by the normal due date for the 5500. In the instance of a calendar year plan, Form 5558 must be filed no later than July 31st. This will extend the filing deadline to October 15th.

- Dissemination of the Summary of Benefits and Coverage: Under its final rule of the Patient Protection and Affordable Care Act, U.S. health insurers and group health plan providers must provide a summary of benefits and coverage (“SBC”) to participants and beneficiaries who are eligible to enroll or re-enroll in group health coverage through an open enrollment period. Respecting newly underwritten coverage, employers must provide the SBCs within seven (7) business days of a request for information related to a specific plan. Respecting renewed coverage, the following SBC distribution rules apply:

- Must be provided at any time requested by the group administrator;

- Open enrollment period – Must be provided with open enrollment materials;

- If the employer does not have an open enrollment period, SBCs must be provided at least thirty (30) days prior to the renewal date;

- When the renewal is automatic and the renewal has not been issued at least thirty (30) days prior to the renewal date, then the SBC must be issued within seven (7) business days of the date the benefits are finalized;

- SBCs must be provided any time it is requested by a member for plan years beginning on or after September 23, 2012; and

- SBCs must be distributed to new hire eligible employees after renewal dates, beginning on or after September 23, 2012.

- Submission of DOL Form M-1: Form M-1 is an annual report that must be filed by Multiple Employer Welfare Arrangements (“MEWAs”). In general, MEWAs are arrangements that offer health and other welfare benefits to the employees of two or more different employers that are not part of the same controlled group of businesses. MEWAs do not include plans the Secretary of Labor determines to be collectively bargained. A MEWA must file an M-1 (MEWA registration) 30 days prior to beginning to operate in a state. A MEWA must file an M-1 (MEWA registration) within 30 days of:

- The MEWA begins knowingly operating in any additional State;

- The MEWA begins operating following a merger with another MEWA;

- The number of covered employees under the MEWA is at least 50 percent greater than the number of such employees on the last day of the previous calendar year; or

- The MEWA experiences a material change to its custodial or financial information.

Summary

With rising noncompliance costs, plan sponsors and their benefits consultants and brokers must remain vigilant in their compliance efforts.

Additional Resources:

For more information

We’re ready when you are. Get in touch and a friendly, knowledgeable Baldwin advisor is prepared to discuss your business or individual needs, ask a few questions to get the full picture, and make a plan to follow up.

This document is intended for general information purposes only and should not be construed as advice or opinions on any specific facts or circumstances. The content of this document is made available on an “as is” basis, without warranty of any kind. The Baldwin Insurance Group Holdings, LLC (“The Baldwin Group”), its affiliates, and subsidiaries do not guarantee that this information is, or can be relied on for, compliance with any law or regulation, assurance against preventable losses, or freedom from legal liability. This publication is not intended to be legal, underwriting, or any other type of professional advice. The Baldwin Group does not guarantee any particular outcome and makes no commitment to update any information herein or remove any items that are no longer accurate or complete. Furthermore, The Baldwin Group does not assume any liability to any person or organization for loss or damage caused by or resulting from any reliance placed on that content. Persons requiring advice should always consult an independent adviser.

The Baldwin Group offers insurance services through one or more of its insurance licensed entities. Each of the entities may be known by one or more of the logos displayed; all insurance commerce is only conducted through The Baldwin Group insurance licensed entities. This material is not an offer to sell insurance.