Risk Mitigation Services

Risk control | Claims advocacy | Data analytics

COMPREHENSIVE GUIDANCE

Providing measurable, sustainable strategies

TRUSTED APPROACH

Steadfast guidance backed by data

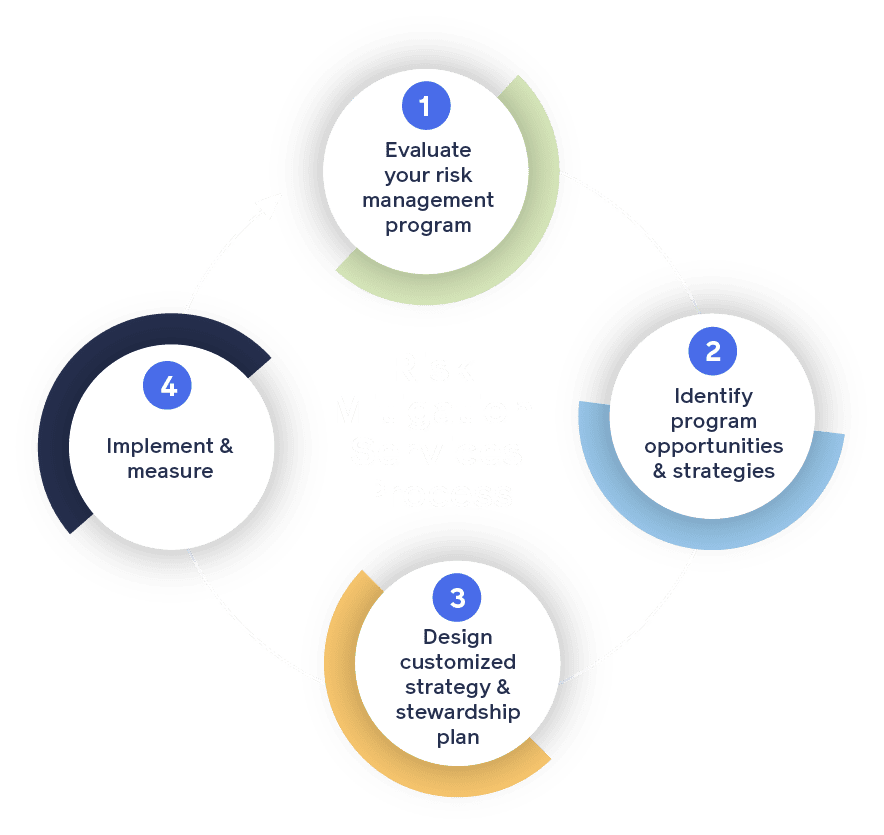

Evaluate

Beginning with our proprietary RiskMap and Baseline Risk Assessment, we’ll evaluate your risk management program to gain a better understanding of your business, team, and culture.

Identify

After comparing the findings against industry best practices, we’ll identify program opportunities and strategies to help reduce your total cost of risk, enabling your company to focus on your core business mission and objectives.

Design

In collaboration with you, we’ll design a customized, best-in-class risk mitigation strategy and stewardship plan to address opportunities and maximize return on investment.

Implement and measure

You’re ready to implement your risk mitigation strategy and stewardship plan. We’ll assist you with implementation, as well as conduct regular analysis to measure ongoing progress and make any recommended program adjustments.

ENHANCED TOOLS & RESOURCES

Innovative solutions, powered by technology

Make decisions that help reduce your risk by tapping into the power of your specific business intelligence. Powered by Origami Risk, ARC (Analytics, Risk insight, Claims), is an industry-leading digital and online risk management information system (RMIS) designed to give you clear, continuous insights into your risks, distilled directly from your business data. ARC compiles data from multiple sources and displays it in meaningful ways, which allows our experts and your leadership to make informed decisions that help you maximize the return on investment you make in risk mitigation.

Key features include:

- Incident and intake management – ARC’s configurable incident intake system allows you to capture and report incident details, automates root cause analysis, and captures investigation details.

- Claims management – ARC enhances the claims process by automating communications to appropriate leaders and managers when specific changes to a claim occur so you can initiate the proper next steps, at the right time.

- Analytics and reporting – Analytics and benchmarking in ARC help make data analysis straightforward and fast. Use dashboards, reports, and graphs to gain actionable insight across your entire risk environment.

- Data visualization – The platform translates your data into digestible information, mapping over bodies of land, heat maps, road systems, body systems, and more.

- Audit and inspections –With ARC, you can go digital with your inspection and audit processes, gain more control over data quality, and spur corrective actions that help prevent losses and keep you compliant.

- Technology – ARC is hosted on a reliable, fast, and secure web-based platform, which allows continual system functionality and security without the installation or maintenance of any hardware.

- Data security – ARC maintains compliance with SOC2 and NIST800-53 and has joined the EU-U.S. Privacy Shield Framework and Swiss-U.S. Privacy Shield Framework.

RISK MITIGATION

Boosting resiliency, improving outcomes

The investments you make today to mitigate your exposures, minimize losses, and strengthen your risk resiliency can pay dividends for your organization in the years to come. At The Baldwin Group, we understand that the best risk mitigation strategies and programs are unique and customized to your business, which is why our approach focuses on your distinct needs, designing streamlined risk mitigation programs and processes that help achieve world-class results.

Our proprietary risk mitigation approach integrates tools, resources, and expertise from three distinct, yet complementary, disciplines: risk control, claims advocacy, and data science and analytics.

Risk control

Get the support of our consultative risk control teams and expert advisors to help you positively impact your business’ total cost of risk. Serving as an extension of your team, our expert advisors will help you with loss prevention, event response, and post-loss evaluation services. And our loss control teams can help build and deploy effective Environmental, Health, and Safety (EHS) programs and navigate the often challenging federal and state regulatory requirements (e.g., OSHA, DOT, etc.) that can impact your business.

We’ll help you implement a measurable, sustainable, and flexible approach that can help improve your overall risk profile and mitigate your total cost of risk.

Some examples of our comprehensive offerings include:

- Risk assessment and evaluation

- Workplace safety processes and programs

- Regulatory programs and training materials (OSHA, DOT, etc.)

- High-impact loss driver identification

- Disaster/emergency plans and response

Claims advocacy

The Baldwin Group’s claims advocacy team proactively engages with clients to help manage and simplify the complex course of a claim. We roll up our sleeves and work directly with you, your claim service provider, and other key partners to help ensure appropriate resources are considered that could reduce overall costs and to deploy viable resolution strategies – before, during, and after a loss.

- Coverage and claims dispute resolution

- Pre-, active-, post-claims mitigation strategies

- Regulatory and legal expertise

- Outcomes-based claims mitigation services

- Catastrophic event preparedness and response support

Data science & analytics

The data science and analytics solutions we use are customized to align with your business’ unique risk profile. To get started, our data science and analytics teams procure, organize, and transform your risk management data into actionable business intelligence utilizing our proprietary ARC system (Analytics, Risk Insight, Claims Management) that illustrates your organization’s performance over time, opportunities for improvement, viable solution options, and more. We also use your risk management data to help improve your overall insurance architecture and pricing through our alternative risk solutions team.

Some examples of our deliverables are as follows:

- Performance and trend analysis

- Loss stratifications, forecasting, and projections

- Experience Modification Factor (EMOD) validation and forecasting

- Insurance program analysis (captives, deductibles/SIR, collateral, reserve, total cost of risk, etc.)

- Benchmarking and KPI development

KNOWLEDGE CENTER

Guiding you with proven expertise

THE BALDWIN GROUP INSIGHTS

Stay in the know

Our experts monitor your industry and global events to provide meaningful insights and help break down what you need to know, potential impacts, and how you should respond.

Your journey begins here

When you decide to partner with us, you choose to protect your business and open the door to new ventures and opportunities.