International Personal Travel

COMPREHENSIVE PROTECTION

Stay protected, all over the world

BATTLEFACE DISCOVERY PLAN

Custom travel protection you can count on

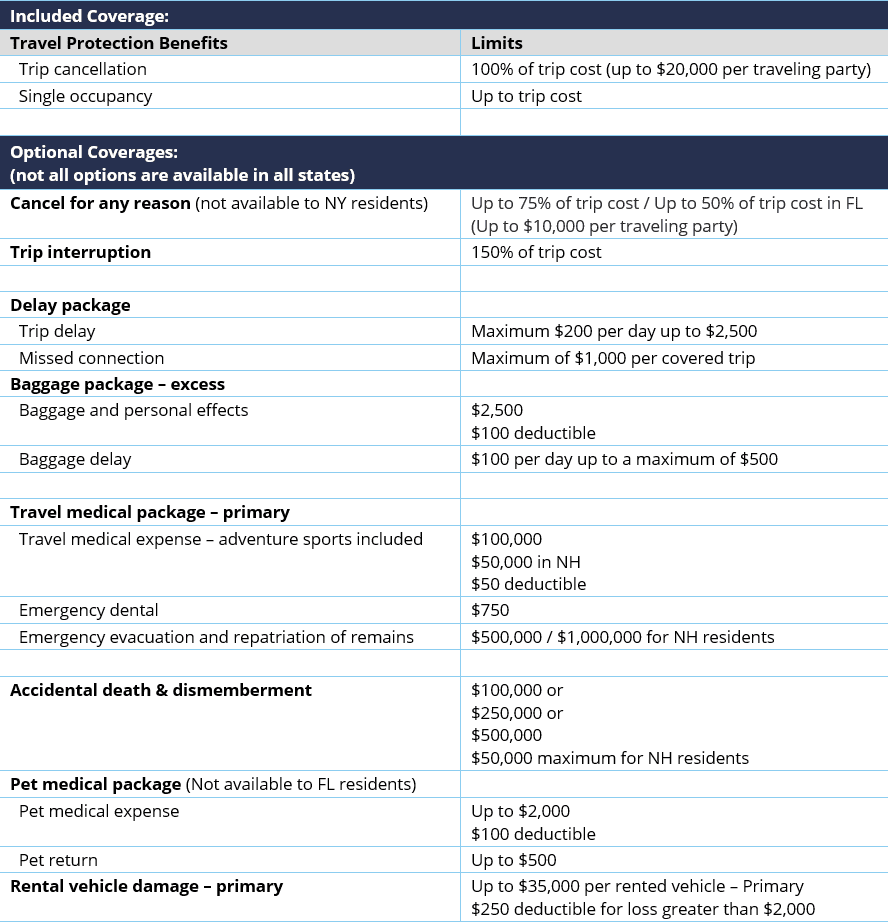

In the ever-changing insurance marketplace, it’s important to understand your coverage options and have the ability to tailor your insurance package. We work to find the best partners to provide bespoke travel insurance for all our clients’ needs. Through our partnership with battleface, a trusted travel insurance company, you have access to their Discovery Plan and can customize your ideal coverage plan – only selecting benefits you will need.

Through the battleface Discovery Plan, you’ll get these benefits:

- 24/7 emergency and travel assistance

- Available coverage for pre-existing medical conditions*

- Available cancel for any reason coverage*

- Coverage for adventure activities – road trips, tours, hiking, vacation rentals and more

- Optional coverages including, travel medical, trip interruption, pet medical, and more

INTERNATIONAL MEDICAL INSURANCE

Cigna global health benefits

International medical insurance is a type of insurance policy that offers comprehensive healthcare coverage to individuals living or working abroad. Unlike travel insurance, which usually just covers emergencies for short periods away from home, international medical insurance is intended for longer-term travelers and expatriates. It is crucial for individuals who travel or live abroad to help ensure you’re as protected as possible in the event of an emergency or medical need outside the U.S.

See why it’s essential to consider:

Coverage beyond borders

- Local health plans limitations: Most health insurance plans are designed to cover medical expenses within the country of residence. When you travel internationally, your existing health coverage may not apply effectively.

- Global protection: International medical insurance helps ensure that you have access to quality healthcare wherever you are. It covers emergency medical expenses, including hospitalization, outpatient care, and wellness services.

Pre-existing conditions:

- Coverage for pre-existing conditions: Some international insurance plans offer coverage for pre-existing medical conditions. This is especially important for travelers with chronic health conditions. Be sure to understand the terms related to pre-existing conditions in your chosen plan.

Emergency situations:

- Unexpected illness or injury: International health insurance provides reimbursement for emergency medical expenses, including medical evacuations.

- Travel confidently: Knowing you’re as protected as possible in case of a medical emergency allows you to focus on enjoying your travels without worry.

Visa Requirements:

- Visa necessity: Many countries require proof of adequate health coverage for visa issuance. International medical insurance fulfills this requirement.

- Smooth visa process: Having the right insurance can expedite your visa application process.

Financial Protection:

- Costly medical expenses: Healthcare costs can be steep in some countries. International insurance provides financial protection against unexpected medical bills.

- Emergency evacuation: If you need to be evacuated to your home country for medical reasons, the insurance covers these expenses.

Flexible Plans:

- Customizable options: Choose a plan that fits your needs. Options include levels of coverage, additional extras, and excesses.

- 24/7 support: International insurers offer round-the-clock support from in-house clinicians and multilingual case managers.

THE BALDWIN GROUP INSIGHTS

Stay in the know

Our experts monitor your industry and global events to provide meaningful insights and help break down what you need to know, potential impacts, and how you should respond.

Travel with confidence

Whether you’re ready to get started or just have a few questions, we’re here to help. Our risk advisors are available to guide you every step of the way – helping ensure you find the coverage that’s right for you.

*Must purchase the plan within 15 days of initial trip deposit, and insure entire trip cost, to qualify for waiver of Pre-Existing Medical Conditions exclusion. Cancel For Any Reason Coverage must be purchased within 15 days of initial trip deposit and more than 10 days before departure date, must insure the full trip cost, and cancel before 48 hours of scheduled departure.

Important Note: battleface Travel Insurance plans are underwritten by Spinnaker Insurance Company (an IL Corporation, NAIC# 24376), with administrative office at One Pluckemin Way, Suite 102, Bedminster, NJ 07921. Plans are offered and administered by battleface Insurance Services LLC,45 East Lincoln Street, Columbus, OH 43215, National Producer Number 18731960 (FL License number L107363/CA License number 0M75381). Travel retailers offering this plan may not be licensed insurance producers and cannot answer technical questions about the terms, benefits exclusions, and conditions of this insurance or evaluate the adequacy of your existing insurance. Your travel retailer may be compensated for the purchase of a plan and may provide general information about the plans offered, including a description of the coverage and price. The purchase of this plan is not required in order to purchase other travel products or services offered by your travel retailer. This is a brief description of the coverage provided under policy series RIG-1000, the Policy will contain reductions, limitations, exclusions and termination provisions. Please refer to the policy for complete details. If there are conflicts between the information on this site and the Policy, the Policy will govern in all cases. Not all products or coverages may be available in all jurisdictions. Non-insurance assistance services are provided by Robin Assist LLC (in CA: battleface Insurance Services dba Robin Assist).