Insurance for small business owners

Every business faces risks, but with the right insurance program, you can be better protected. Focus on growing your business and let us make it easier for you to compare business owner’s policies, general liability, and commercial property insurance.

INSURANCE THAT GROWS WITH YOU

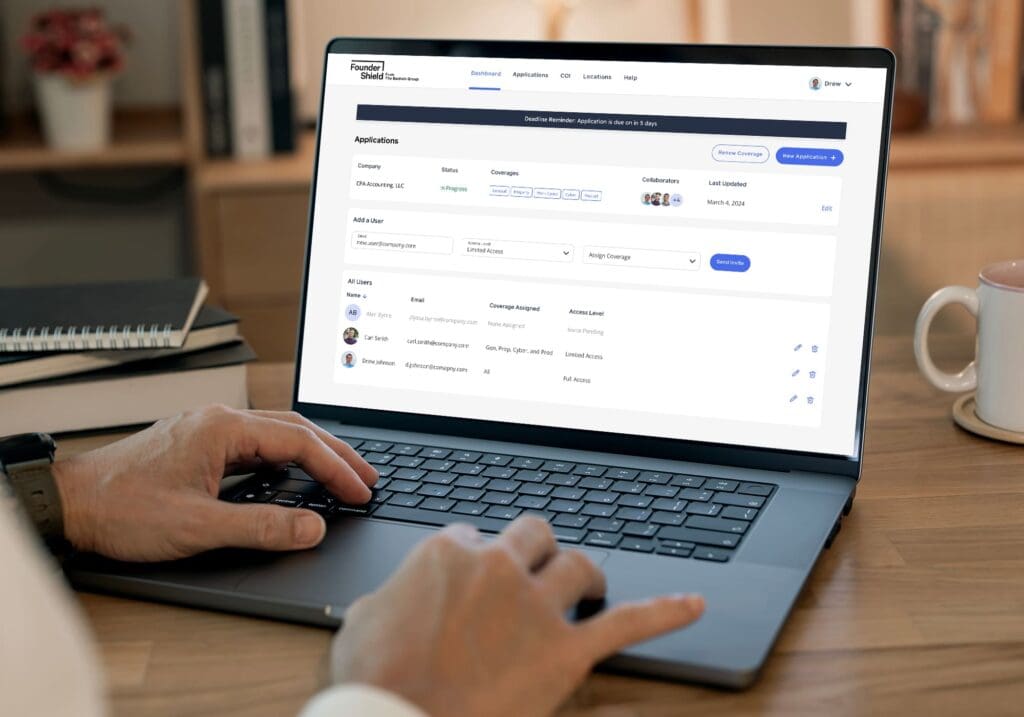

Simplifying insurance with smart technology

Apply, renew, and manage your coverage using our Founder Shield platform that helps streamline the insurance process. With automated paperwork and direct insurer connections, you’ll receive a seamless experience that grows with your business.

SMALL BUSINESS SOLUTIONS

Protecting what you’ve worked so hard to build

Every business has unique insurance needs. Whether you’re a startup or a well-established local business, our experts help you find the right coverage.

Business owner’s policy (BOP)

A business owner’s policy, also known as a BOP, combines general liability and property insurance into one convenient package, helping protect against common risks, like property damage, business interruption, and lawsuits.

General liability insurance

Protect your business from costly claims. General liability insurance covers third-party injuries, property damage, and legal fees, helping to keep you financially secure and prepared for the unexpected.

Commercial property insurance

Your business property is essential to your operations. Commercial property insurance covers buildings, equipment, and inventory against fire, theft, and other unexpected events.

Workers’ compensation insurance

Keep your employees better protected. Workers’ compensation insurance provides medical benefits and wage replacement for work-related injuries or illnesses.

Professional liability insurance

Also known as errors & omissions (E&O) insurance, professional liability coverage helps protect businesses that provide professional services from claims of negligence or mistakes.

Cyber liability insurance

In today’s digital world, cyber threats are a tangible risk. Cyber liability insurance helps safeguard your business against the effects of data breaches and cyberattacks—helping mitigate financial and reputational losses.

INSURANCE INSIGHTS

Stay informed, stay protected

Explore expert insights, risk management tips, and coverage options to help safeguard your small business.

INSURANCE FOR SMALL AND LOCAL BUSINESSES

The coverage your business deserves

Take the first step in securing your business today. Our easy-to-use platform helps you compare small business insurance options and find the best coverage to fit your needs.